Crypto | An API-Based Composable Financial System

Crypto & blockchain technology are revolutionizing the financial system, merging technology with money to unlock the future financial system we all deserve.

Welcome to the latest edition of ‘The API Economy’ — thanks for being here.

To support The API Economy, be one of the 4,333 early & forward-thinking people who subscribe for monthly-ish insights on the API economy, Crypto, AI, and more emerging trends.

The contrast between traditional finance (TradFi) and cryptocurrency has become a fork in the financial system. Traditional institutions have shown hesitation to embrace crypto and blockchain technology because, at its core, it disrupts many of their traditional business models.

TradFi, rooted in a long history, operates within a framework of physical instruments, centralized control, and a fixed schedule (typically adhering to conventional 9-5 working hours). While familiar and established, this system often grapples with inflexibility and restricted access limitations.

Crypto represents a radical departure from these norms (as seen in popular ad campaigns like Coinbase’s infamous ‘Update the system’ campaign’ & Circle’s ‘How USDC is changing the global economy’).

These glaring holes in the current financial system seem to become clearer every day. While we’ve become accustomed to instant communication, streaming, access to goods & services, and the ability to do almost anything from our phones, the current financial system has yet to embrace the revolution.

At its core lies blockchain technology, a decentralized ledger that defies the conventional boundaries of control and operation. Unlike traditional finance, cryptocurrency thrives on digital and decentralized infrastructure, offering a new paradigm of financial interaction.

Blockchain & crypto technology's core is rooted in 'composability,’ where financial services and products are designed to seamlessly integrate and build upon each other in a composable system. This interoperability is a hallmark of cryptocurrency, enabling a dynamic and ever-evolving financial ecosystem.

The composable nature of these systems enables the creation of a more cohesive and adaptable financial network, allowing for unprecedented levels of innovation and customization in financial products and services.

In this essay, we’ll explore the impact of cryptocurrency as an API-based, composable financial system. It contrasts the rigid, time-bound nature of traditional banking with the fluid, always-on approach of crypto, underscoring how this innovative model presents a more integrated, efficient, and universally accessible alternative in the financial sector.

Let’s dive in.

Understanding The Traditional Banking System

Traditional banking systems are entrenched in a centralized structure, heavily reliant on a network of physical branches and headquarters. This setup significantly influences how these institutions operate and interact with their customers, with these limitations & heavy overhead leaving opportunities for Fintechs & Crypto alike.

In the podcast episode, ‘Nubank: David vs Goliaths,’ they describe the chain of events that led to NuBank (a Latin American Fintech Super App that leverages crypto) founder David Vélez starting the company in 2013 out of the pressing need people had for better access to their finances:

“So he was saying that he was a fresh expat living in Brazil for the second time in his career, and he was attempting to open a bank account at the branch of one of the largest banks in the country. And so he recalled going to the bank and being greeted at a bulletproof door that was flanked by armed security guards. And so he's thinking, what the heck is going on?

And then he goes on to say that after a few months, not days, months of spending multiple long hours in lines being on the phone with customer service and having to go back to the branch several times, he finally got his account open. So that's the sort of experience that Brazilians have been dealing with for decades. And the second unique condition that emerged is that the Brazilian population was increasingly growing either unbanked or underserved.”

While this is an extreme example, I think we all have stories about how the financial system has failed us, whether it’s having to go somewhere inconvenient to address an issue, a problem with fees, or having to deal with the hurdles to send a wire (or even lose it).

Another key limitation of the traditional financial system is the outdated limitations of its 9–5 / Monday-Friday operating schedule. In the last 25 years, the internet has made us expect instant access to everything, not “come back when we’re open.”

People and businesses require 24/7 financial services, and the technology exists to break the traditional mold.

Another problem that our current financial system has is that it has so much technical debt that makes it difficult to innovate. These systems today often operate in silos, with systems and services that lack the flexibility to integrate seamlessly with new technologies or offerings. The old and antiquated systems built on dinosaur technology lead to inefficiencies, limited financial products, and a sluggish response to market changes.

This leads to internal challenges and the challenges banks face in integrating with other financial services and adapting to digital banking needs. Existing infrastructures often act as barriers to innovation, hindering the banks' ability to adapt to a rapidly evolving financial sector. This has led to the rise of fintech & crypto.

TradFi's cost for overhauling the current system is upfront and impacts their bottom line. First, they need to decouple complex systems to make way for better technology, which is costly. This requires embracing crypto, fintech, and other technologies that improve the current system.

Second, they must reconsider a completely new business model that doesn’t prey on customers' fees (especially for low-income people). To make our financial systems more accessible, better to use, and more robust than ever, we must remove many of the fees, minimums, and other outdated rules that have plagued the traditional financial system for years.

These updates can help bring more people into the financial system, help more people financially prosper, and have a wave of economic benefits for centuries to come. This wave of new demand will create new business model opportunities that will evolve as this market is created.

The flexibility, innovation, and round-the-clock accessibility offered by cryptocurrency and blockchain technology exist to enable these changes. The momentum to upgrade our financial systems using blockchain technology is here. But change is hard, and disrupting the largest business in the world is a big task that crypto has embarked on. To give perspective on the opportunity, $8 trillion moves between different currencies every single day. It’s about 30 times the daily global GDP.

Why Crypto

In the dynamic fintech landscape, cryptocurrency is a beacon of innovation, primarily due to its core attribute: composability.

In ‘Composability is Innovation’ by Linda Xie (formerly at a16z), they say this about composability:

“Composability leads inevitably toward more choice, and better user experiences, because there are no obstacles to someone taking an existing idea and making it easier to use, or adapting it to new use cases. As more and more of the underlying technology gets abstracted away, the focus will shift towards what people can do with their money, and not the inefficiency that marks much of the traditional finance world.”

The concept of composability in the crypto world is akin to the fluidity and interconnectedness of self-sustaining ecosystems in nature, where each element coexists, coevolves, and strengthens the other.

Composability in crypto enables a seamless blend of services and products. This interconnectedness allows for the creation of sophisticated financial services that can effortlessly integrate and interact, fostering an environment ripe for innovation and growth.

APIs in crypto enable access to different financial services, like lending, asset management, and payments, to integrate seamlessly, crafting a financial ecosystem that is far more cohesive and efficient than traditional systems.

For instance, envision a scenario where transferring funds, trading assets, and accessing credit can occur in a single, integrated platform without navigating multiple disconnected services. This is the promise of composability in crypto, realized through the power of APIs.

When you think about this new financial paradigm, the traditional financial system feels antiquated with its rigid structures and isolated operations. It’s like comparing a vast, interconnected digital network to a series of isolated analog systems.

Through its composability, Crypto brings about a level of flexibility and innovation that is a leap forward from traditional financial institutions' conventional, compartmentalized approach.

On the Lightspeed podcast, Nic Carter discussed ‘The Next Chapter for Stablecoins’ and described why crypto represents an overhaul to the existing financial system:

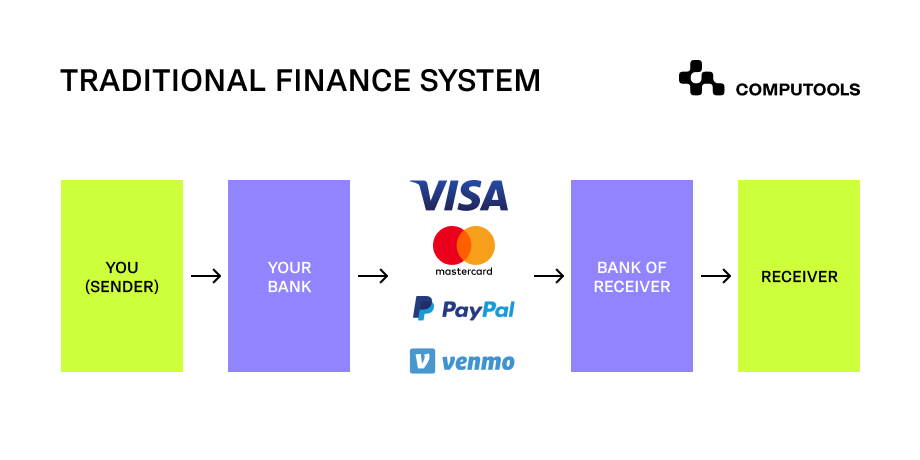

“If you look at what Crypto is actually competing with, which is the legacy correspondent banking system, that is a highly non-composable system.

You don't really have the ability to interact with the financial system on an API basis and it's heavily, heavily intermediated. If I'm making a transaction from Jakarta to Mexico City, it has to go through London or go through New York. It has to do all these hops to get to one of the (financial) hubs and then all these hops to get to the other destination.

That's the status quo that we always need to keep in mind as our North Star. We need to be better than that. That's why stablecoins are so great. Because I can create (mint) USDC with dollars here in the US and then send it to anywhere really, and as long as there's some, you know, ultimate last-mile fiat conversion now, that's a three-hop process as opposed to a fifty-hop process with tons of intermediation and tons of costs.

That's why remittances are expensive because you have to do all these transactions. Like going from bank to bank to bank to bank to London or to New York, then bank to bank to bank to bank again to get to the destination. I would encourage people to think of those terms and not in like these crypto native terms, actually.

So then we get back to composability, and what made DeFi so great was its composable nature. I mean, it's a poison chalice as well because if something breaks, then everything that relies on it breaks too. Let's just assume we can sort of figure that out eventually. The status quo you have on Ethereum now is challenging that.

The value of crypto is to have everybody on a shared big network.”

This type of composability in finance is not just a technical feat; it's a gateway to a more inclusive and accessible financial world. It heralds a future where financial services are tailored to the unique needs of each individual, transcending geographical boundaries and time zones.

It's a vision of a world where finance is not just a tool for the privileged but an empowering platform accessible to all, irrespective of location or economic status.

One of my favorite quotes on composability is from The Tim Ferris Podcast, where Naval Ravikant said,

“Compossibility is the ultimate open API.”

Crypto, guided by the principle of composability and the innovative use of APIs, is a testament to the boundless potential of financial technology. It’s a narrative of transformation, where the rigid, compartmentalized structures of the past give way to a more integrated, efficient, and inclusive financial future available everywhere, at any moment.

24/7/365

Crypto has broken down one of the most improbable doors in the financial world. The way crypto allows any financial-based system to adopt a 24/7/365 operational model represents a paradigm shift, challenging the traditional banking system's confined schedule and offering a glimpse into a future of continuous financial connectivity.

In the traditional banking landscape, the limitations of operating hours are not just a minor inconvenience; they reflect a deeper misalignment with the globalized and digital nature of modern life.

*Gif Source: a16z’s Global Payments

In contrast, the crypto world operates non-stop, mirroring the internet's always-on ethos. This continuous operation aligns perfectly with the needs of a global economy, where geographical boundaries or time zones do not bind financial transactions.

It's like the transformation from having to go to the post office to send a letter to be able to send an email or text message instantly and for free.

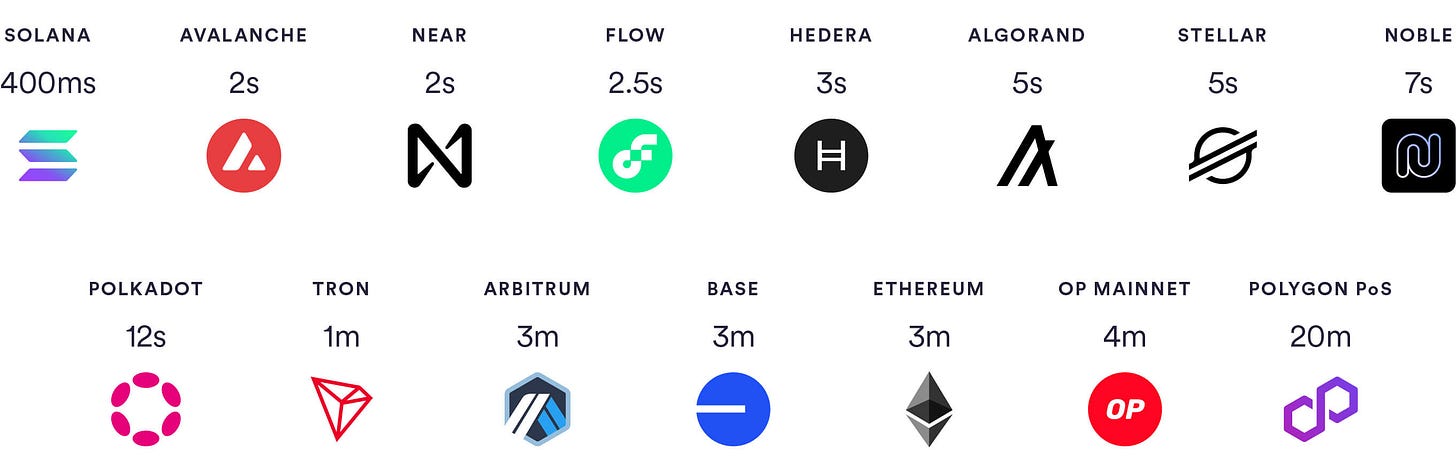

The 24/7 nature of cryptocurrency also facilitates real-time financial processes, paving the way for innovations like instant cross-border payments and real-time settlement systems. This immediacy is a leap forward from the often slow and cumbersome processes of traditional banking, where transactions can take days to clear.

Visa is taking advantage of crypto for payment transformation. Through live pilots with issuers and acquirers, Visa has already moved millions of USDC between its partners over the Solana and Ethereum blockchain networks to settle fiat-denominated payments authorized over VisaNet.

Decentralized and Transparent

The decentralized nature of cryptocurrency is another key benefit. Unlike traditional banking systems, which are centralized and can be subject to government or institutional control, cryptocurrencies operate on decentralized networks, often making them more resistant to censorship and central points of failure.

This decentralization enhances security and fosters a sense of empowerment among users, giving them more control over their financial assets.

Cryptocurrency introduces a new level of transparency in financial transactions. Thanks to the underlying blockchain technology, all transactions are recorded on a public ledger, making them easily verifiable and transparent. This transparency is a stark contrast to the often opaque processes of traditional banking, where the inner workings of financial transactions are not always visible to the participants.

The advantages of cryptocurrency over traditional banking are profound and varied. From enhanced flexibility, efficiency, and speed to broader financial inclusion, decentralization, and transparency, these benefits represent a reimagining of financial systems. They paint a picture of a future where financial services align more with the needs and realities of a digital, globalized world, offering a more equitable and efficient financial landscape for all.

Asset Tokenization Is Up Next

An exciting area where crypto is improving TradFi today is within asset tokenization & the tokenization of real world assets (RWA). Asset tokenization converts illiquid assets into digital tokens that can be traded on a blockchain. This makes assets more accessible to a wider range of investors, increases liquidity, and reduces the cost of trading assets. Asset tokenization also makes trading assets available 24/7.

The benefits of tokenization are hard to overstate. It democratizes access to investment opportunities, allowing a broader range of investors to participate in markets previously restricted to wealthy or institutional investors.

For example, tokenizing real estate enables individuals to invest in fractional property ownership, lowering the entry barrier to real estate investment. Tokenization enhances liquidity, as these digital assets can be traded more freely and efficiently than their traditional counterparts. This increased liquidity benefits investors and asset owners, who can more readily access a broader market and capital.

This is one example of many demonstrating that cryptocurrency is not just a speculative asset but a foundational technology that can revolutionize how we interact with and conceive of financial systems.

As these applications continue to evolve and mature, they pave the way for a financial future that is more inclusive, agile, and aligned with the needs of a digital, interconnected world.

Closing Thoughts

Exploring an API-based, composable financial system that leverages crypto & blockchain technology reveals an innovative and transformative future of finance.

Where historically, financial transactions were confined to business hours and centralized institutions, cryptocurrency has ushered in an era of continuous, decentralized, and inclusive financial services. The implications of this shift are far-reaching, extending beyond mere convenience to fundamentally altering how we interact with money and financial assets.

As we stand on the cusp of this financial revolution, it is clear that cryptocurrency is more than a digital asset; it is a catalyst for change. It challenges traditional models and paves the way for a financial system more aligned with the digital age's transparency, efficiency, and inclusivity demands. This includes a future where:

Everyone in the world has access to the financial system digitally.

The cost to acquire, send, and trade money worldwide costs nothing and happens instantly.

All financial markets and instruments follow the same trends.

The economic prosperity and financial freedom a future like this unlocks help us move to a global economy with limitless potential.

The journey of cryptocurrency from a niche digital currency based on memes to a cornerstone of a new financial paradigm exemplifies the potential of technology to reshape our world. As this journey continues, it holds the promise of a financial system that is not only more efficient and accessible but also more attuned to the needs of a globally connected digital society.

In envisioning the future of finance, the always-on characteristic of cryptocurrency is not just a feature; it’s a fundamental reimagining of how financial services can and should operate in a digital age. It's a vision of a world where financial services are as accessible and continuous as the internet, promising a more connected, efficient, and inclusive global financial ecosystem.

Until our next adventure.

Special thanks to Mama Schroeder for editing this essay (any typos are on her 😊).

*Disclaimers: The views in this essay are my personal opinions and don’t necessarily represent the views of my employer, those mentioned in this article, or anyone other than myself.

incredibly well-articulated piece digestible by normies!