Plaid: Bridging TradFi to Crypto & Beyond

How Plaid is crossing the chasm of traditional finance to onboard the next billion users onto Web3.

Welcome to the newest edition of ‘The API Economy.’

Thanks for reading. Be one of the 1,840 early, forward-thinking people, to subscribe to the newsletter for monthly insights on The API Economy, crypto, Web3, and more.

Plaid = the business of connections

The future of finance is anything but traditional, and API-first tech company Plaid is helping bring that future to fruition through the power of connections.

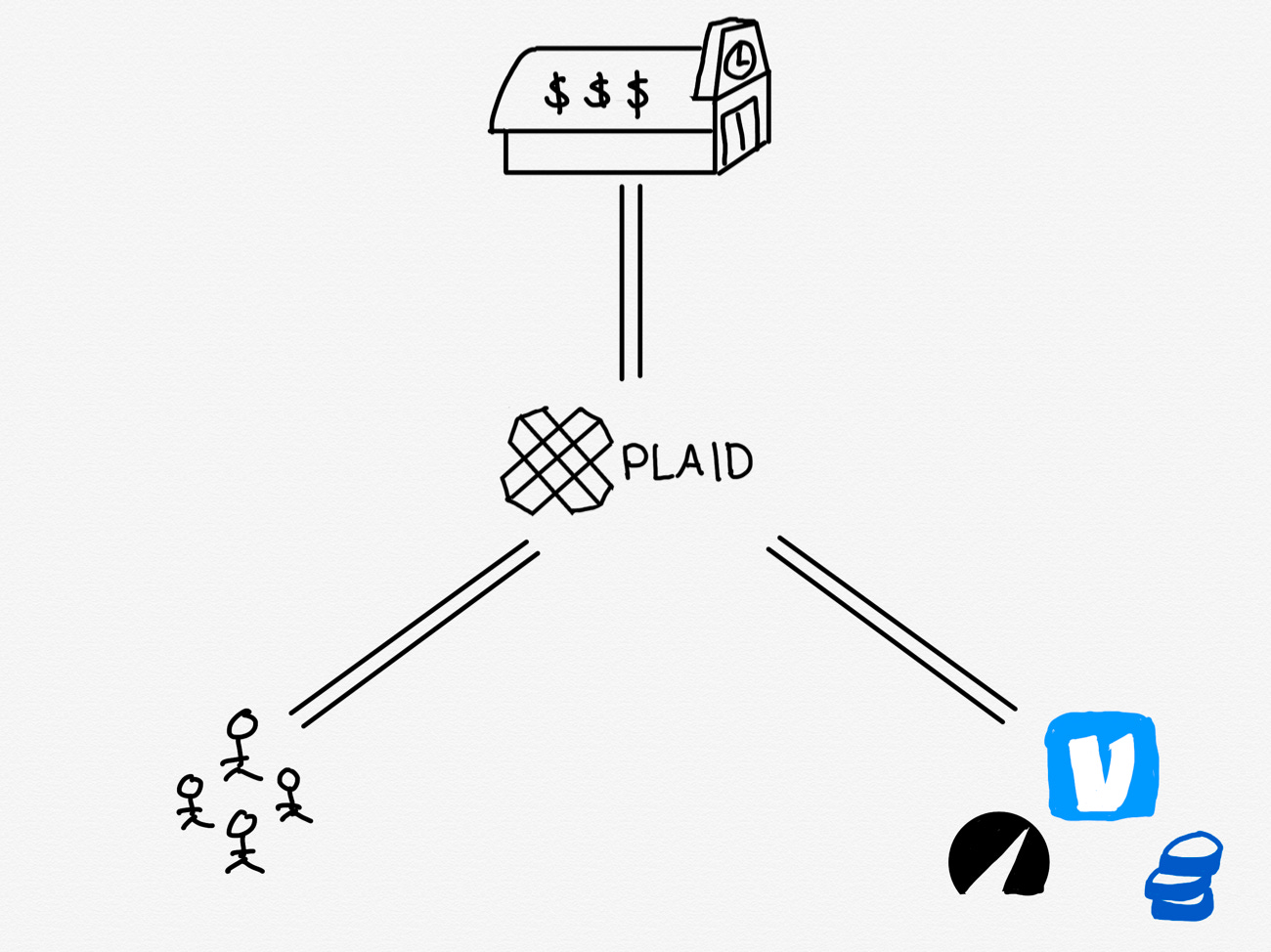

Whether or not you’re aware of them, chances are you’re one of the 10 million+ people who have used Plaid to connect a bank account to an app like Venmo, Robinhood, or Coinbase.

Sometimes called the “plumbing” of the financial world, Plaid has made it easy for consumers to securely link their bank accounts to a myriad of financial apps and services. Their API has also enabled thousands of partners to meet their customers’ needs faster since they don’t have to waste time building their own solutions to a complicated process.

Founded in 2013 by Zach Perret and William Hockey, Plaid is the 8th most valuable API-first company, now valued at an incredible $13.4 billion. Their platform supports 12,000 financial institutions and is used by 6,000+ Fintech companies, from pay-later service Affirm to Rocket Money (formerly known as Truebill).

From almost getting acquired by Visa, to more recent forages in the world of Cryptocurrency, Plaid has made waves in the Fintech world. With a grand mission in mind (to “unlock financial freedom for everyone”) it doesn’t look like they have plans to stop anytime soon.

In this month’s newsletter, we’re here to share more about where Plaid came from, what’s special about its API-first approach, and its big potential in Web3.

Plaid’s early beginnings

Plaid co-founders Zach Perret and William Hockey originally met in Atlanta while working at Bain & Co. After less than a year, they quit their jobs as consultants to start working on a consumer finance app.

Their original goal was to simplify consumer finance by creating apps and software for budgeting, bookkeeping, and more. After a few failed attempts to get something solid off the ground, Perret and Hockey recognized that they were repeatedly running into the same problem.

Instead of spending valuable time developing the front end of their projects, the co-founders were spending hours upon hours on the backend — trying to establish connections with different banks, so their apps could actually function.

The duo asked themselves the simple question, “why is it so difficult to connect a bank account and get access to my money?” In 2012, this question became even more prevalent with the rise of FinTech and the increasing numbers of people wanting to leverage their money digitally.

This challenge ultimately sparked the idea to build Plaid’s unified banking API. Perret and Hockey realized the tech they had built for their own projects was innovative in itself. They could see it had the potential to help thousands of start-ups get their own fintech products off the ground faster.

Once they hit on their big idea, Perret and Hockey moved to New York and dedicated themselves to building a prototype. Before long, they had an early version of what we now know as Plaid and were able to raise $2.8 million in 2013 to keep developing.

Around this time, founders across the finance world were looking for infrastructure products that could help them build their own products faster. Without these products, start-ups continually faced a huge barrier to entry: building their own platforms for moving money around.

By offering their banking API to these founders, Plaid played a huge role in helping expand the consumer fintech wave of the past few years. Suddenly, it was easy for young companies to offer their customers a secure method for connecting their bank accounts.

Here’s how Adrian Klee describes why APIs are popular in the fintech sector:

“New regulations and technologies, in particular API technology, both (fin)tech companies and non-financial brands have been able to break into the market by unbundling banking product portfolios and offering increased convenience by concentrating on building financial services around customer pain points.

Consumer and business clients place a high premium on convenience and on-demand availability when it comes to their finances, preferring to manage their finances digitally, and use non-banking apps, such as e-commerce providers or third-party software to store payment information or handle transactions. For instance, an increasing amount of non-financial companies are now grabbing a piece of the market, and have been using API technology to expand their business into financial services.”

As the demand for consumer finance products has grown over the years, so has Plaid. They raised an additional $12.5 million in 2014, $44 million in 2016, and $250 million in 2018. Over the years, the company has been backed by the venture arms of American Express, Goldman Sachs, and many more big names in finance.

How Plaid works

So what exactly was the big idea that led to Plaid’s skyrocketing success?

In a nutshell, Plaid’s innovative API completely transformed how the apps you use are able to access your private bank account information. In a world that’s increasingly sensitive about personal data, this is an important achievement.

How many people want access to their bank via apps, you might ask?

Well, Plaid claims nearly 9 in 10 U.S. consumers now use digital apps and services to manage their finances making Plaid’s API even more valuable for thousands of founders who are eager to solve the challenges of conventional consumer finance.

And it’s a great business: users don’t have to create an account with Plaid or pay to use it. Instead, Plaid charges the app itself a fee to provide the service to its customers.

Here’s a quick breakdown of how Plaid works, from the end user’s perspective:

You open an app and are prompted to connect a bank account — think of when you first signed up for a budgeting app or a trading platform like Robinhood.

A Plaid-branded window appears and you’re asked to search for your bank from their network of 10,000+ financial institutions.

Once you choose your institution, you’re taken to your bank’s online banking login (all without ever leaving the original app you were signing up to join!). You enter your username and password.

You’ll then need to authenticate for security purposes (by getting a verification code via text message, for example).

Once you’re verified, you can choose which account(s) you want to connect to the app.

Finish the steps to connect based on the app or service you’re setting up, and that’s it!

Plaid’s API works hard behind the scenes to make this a seamless user experience. While the above steps are happening, Plaid:

Instantly authenticates that you are indeed the owner of your bank account.

Encrypts the data you’ve chosen to share.

Securely shares it with the app you want to use.

From there, Plaid maintains a secure and ongoing connection between your bank and the app. And the best part is they never share your login credentials.

Overall, this quick and deceptively simple process is groundbreaking compared to what businesses and users had to go through to share financial data a few years ago.

Becoming fintech’s rising star

Plaid rose rapidly as it stayed focused on its mission to “make money easier for everyone” — and before long, it captured the attention of finance giant Visa. In January 2020, just before COVID-19 overtook the United States, Plaid announced its plans to sell for $5.3 billion.

Why did Visa care about Plaid? The start-up would provide valuable expansion opportunities for Visa’s infrastructure capabilities. Plus, Plaid’s position as a “middle man” between consumers and their banks made their vast amounts of user data extremely valuable to Visa.

Ben Thomson of Stratechy did a good job simplifying the strategy of why Visa would want to acquire Plaid in his essay Visa, Plaid, Networks, and Jobs: “Plaid has its own three-sided network, but it operates a bit differently than Visa’s:

The benefits to some parts of the network are more obvious than others:

Developers are able to immediately connect to their customer's bank accounts without having to implement custom integrations with thousands of banks or waiting several days for traditional verification methods (making two deposits of less than a dollar and having the customer report how much).

Consumers are able to use new fintech apps like Venmo immediately, without having to wait several days.

Banks…well this is where it gets messy.”

As good as this network sounds, shortly after the deal was announced, the Department of Justice filed an antitrust lawsuit. Their aim was to stop the merger, stating that Plaid was creating a platform that could challenge monopolist Visa.

Basically, their argument was that if Visa acquired Plaid before it had a "chance to succeed," that would create a further monopoly for Visa in the business of online payments. Visa already controlled around 70% of the digital debit card payment market at the time, and acquiring Plaid would prevent them from ever competing in the future.

While Visa argued they could have successfully fought the lawsuit in court, Plaid and Visa eventually announced that they had mutually agreed to cancel the deal. One of the main reasons for stopping the merger was that both companies didn’t want the pain of dealing with regulatory uncertainty for a year or more.

That said, Plaid’s success throughout 2020 surely played a part in the decision, too. Hidden behind the scenes, Plaid acts as key infrastructure for fintech start-ups like Coinbase and Robinhood, both of which saw rapid growth during the pandemic. The result? Plaid saw its own growth skyrocket, increasing its customer base by 60% in 2020 alone.

In ‘Plaid's Quiet End Run’, Mario Gabriele comments on the failed Visa acquisition saying:

“Plaid's success doesn't hinge on its ability to make this end run (the Visa acquisition). Even without touching payments, Perret (Plaid’s founder) can steward the business to an outcome an order of magnitude larger than that offered by Visa. But the blueprint is there. By expanding geographically, Plaid grows its network of banks, further insinuating itself into the financial system's heart. By adding to its product, the company can more directly communicate with consumers, de-risk "pay by bank," and ensure that as new financial products proliferate, Plaid remains essential. In a dynamic, volatile market, Plaid is the quiet constant.”

The failed merger ended up giving Plaid the opportunity to keep expanding. One could even consider the whole situation a lucky break since the deal gave Plaid loads of valuable exposure and increased its visibility in the fintech world.

By 2021, Plaid was already making big waves with a newly announced valuation of $13.4 billion — and this was before they closed another round of funding at $425 million. Looks like it’s only up from here for this rising star.

Going toe-to-toe with Stripe

So far, we’ve only talked about Plaid as an API that connects user bank accounts to third-party services, like apps. It might seem surprising, then, that Plaid has entered a bit of a rivalry with payment technology company Stripe.

Founded in 2010, Stripe provides developers with a simple way to integrate online payment options into their websites. They are now among the most valuable private companies in the world: in March 2021, they were valued at an astonishing $95 billion.

In the past, Stripe’s partnership with Plaid enabled it to accept ACH payments without the hassle of micro-deposit authentication. Stripe would handle the fund's movement as a payment platform, while Plaid would simplify (in other words, tokenize) the ACH verification process.

The partnership has served both companies well — but nothing lasts forever, especially in business.

Many consumer fintech companies share the goal of diversifying their products so they can expand their total potential addressable markets. Acquiring customers is expensive, after all. Finding more ways to monetize the ones you already have is a smart gambit.

Plaid is no exception to this rule. In 2021, they started making some quiet moves with the purchase of payment company Flannel. Though there was no announcement, this acquisition made it clear Plaid hoped to move into the payment tech world sooner rather than later. And ultimately, that would mean competing with Stripe.

Before Plaid could launch its own platform, however, Stripe beat them to the punch. Earlier this year, Stripe launched a new product called Financial Connections. The product allows users to “securely share their financial data” and instantly verify their bank accounts.

If the concept sounds familiar, there is a reason: it makes Financial Connections (and Stripe) a direct competitor to Plaid.

Though there haven’t been any formal statements from Plaid regarding Financial Connections, some people have questioned whether or not Stripe took advantage of its relationship with Plaid — there was even a bit of a Twitter scuffle over it.

Plaid seemed to have assumed they were playing a long, well-thought-out game of chess, but Stripe clearly had other plans.

The two companies have a long history of partnership and collaboration, so it’s easy to see why the product launch was a little controversial. That said, Plaid seems confident in where they stand in the market — CEO Zach Perret hasn’t spoken to the media but has made clear distinctions between Plaid and Stripe’s new product via other forums.

The key differentiator? Plaid remains an innovative API-first company, integrating directly with many banks. Stripe, in contrast, has more of a patchwork solution (and I believe they can still remain frenemies in the long run).

As we’ve discussed already, Plaid is a company that can roll with the punches while continuing to stand strong. But as competition becomes more direct and they begin to eat into each others’ market share, it will be interesting to see what happens next with these two fierce competitors.

More tools to make digital finance possible

Plaid’s core business will probably always be helping consumers securely share account information with trusted third-party applications. However, that hasn’t stopped them from earnestly expanding their product suite.

For one, Plaid recently acquired the industry-leading identity verification platform Cognito. Identity verification is a critical step in many financial processes. But whether it’s opening a new account or reviewing a loan application, this piece of the puzzle can be a major headache.

Plaid’s new Identity Verification solution solves this by enabling partners to verify customer identities in as little as 30 seconds. Analyzing email, phone, IP address, and device ID, Plaid’s sophisticated risk engine is built to help prevent fraud and identify threats. Did we mention the whole process can be automated and optimized for better conversion rates?

In addition, Plaid now offers a product called Monitor, which helps financial institutions and companies stay compliant with ever-changing government sanctions and watchlists. Both products provide great value to their already existing partner base.

Plaid has also furthered its efforts to make ACH payments easier, faster, and more secure — for the consumer and their bank. Typically, ACH payments take 3-5 business days to be processed, but with the launch of Signal, Plaid is helping consumers get access to funds sooner.

Signal measures the likelihood of a transaction being returned, based on over 1,000 risk factors. Using data like Plaid connection activity and bank account usage, Signal then gives companies a risk score to help them evaluate the transaction. This is a big deal for Plaid because it puts them closer to entering the payments industry.

The items mentioned above are just a few solutions from Plaid’s new, ever-growing product suite. It’s clear they have bold plans to grow beyond their early beginnings, and it feels like this is only the first step in their long journey to connecting all of finance (new and old).

One API to unlock financial freedom for everyone

Plaid is focused on democratizing financial services through technology. They build beautiful consumer experiences, developer-friendly infrastructure, and intelligent tools that give everyone the ability to create amazing products that solve big problems.

The company’s vision goes beyond its ability to help consumers securely connect their bank accounts with the apps they love. Though they’re always improving in that area, Plaid is “constantly thinking about how to make connectivity better, more reliable, and more expansive.”

How exactly? By helping build a comprehensive, API-based ecosystem for the Fintech world. To start bringing this huge goal to life, though, Plaid needed to expand its own API to help more customers seamlessly share their financial info with their favorite apps.

But we all know the fintech world is ever evolving, and that’s made some things less than straightforward for Plaid. Cryptocurrency, for one, presents us with a completely new kind of financial data that institutions around the world are still learning how to handle.

That said, Plaid has definitely risen to the occasion. As of today, over 50% of Plaid’s connections now happen through direct APIs, and they have over 1,000 partners committed to utilizing these API integrations.

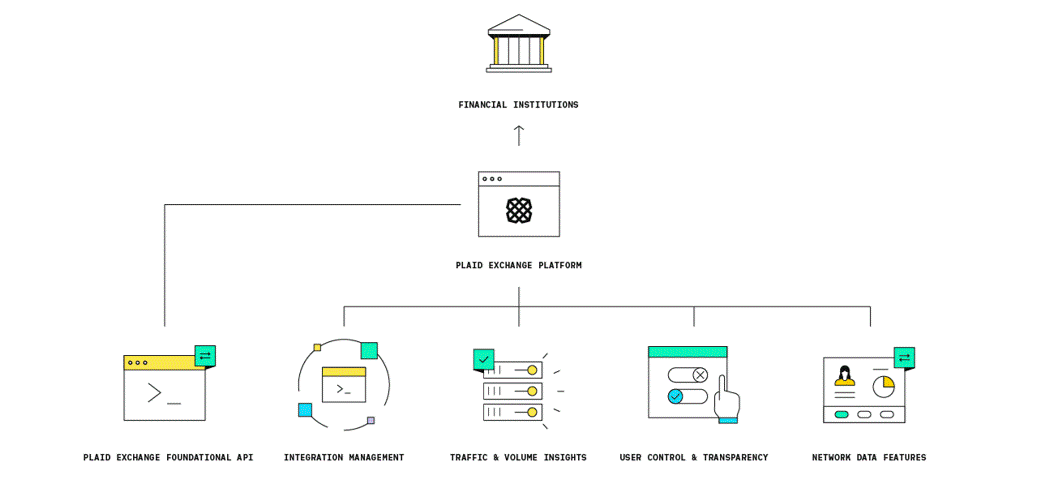

To achieve these numbers and meet growing demand, Plaid has worked to introduce new, innovative data connectivity solutions. Among them is Plaid Exchange, which aims to support API integrations with emerging fintech data types like cryptocurrency.

These exciting new solutions are helping Plaid grow as a business. But they’re also helping develop something bigger (and needed) in fintech: secure and reliable API connectivity.

Web3 Is Calling and Plaid Must Go

A new era of the internet is upon us, and it’s called Web3.

The term Web3 was first coined back in 2014, but if you haven’t heard of it, you’re not alone. Basically, the concept is all about the world’s advance toward a new generation of the internet, decentralized from big corporations like Facebook and Google.

Today, these companies own much of our data, making users more products than participants on the internet. Thought leaders have proposed that in Web3, ownership of data will lie with the individual. In addition, blockchain and cryptocurrency will create more decentralized finance (DeFi), putting power into the hands of individuals.

We still have a long way to go before we’ll reach anything close to a real Web3 world. Yet change is imminent, and Plaid is one of many fintech companies that can’t afford to ignore it: 16% of US adults are already actively using cryptocurrencies.

Plaid has helped thousands of people manage their finances more efficiently and securely. Now, they have the unique opportunity to help bridge the gap between traditional finance (TradFi) and DeFi.

The first way Plaid is doing this is by helping consumers get a more holistic view of their financial lives.

Let’s say you have some investments in crypto (which live on the blockchain) and some in traditional funds (which live in the bank). Maybe you also regularly use your crypto wallet to purchase things, in addition to your checking account.

Plaid already helps you connect your bank accounts to your favorite budgeting, tax planning, and other fintech apps. Now, they’re taking a step into Web3 by integrating with cryptocurrency exchanges and investing platforms. This gives consumers the ability to see and manage all of their finances in one place (their app of choice), without having to worry about security issues.

In addition, Plaid is working towards creating a more open financial ecosystem. Historically, there have been high barriers to entry in the cryptocurrency world. The process of actually getting, holding onto, and using crypto was only possible for experts.

But the times are changing. Today, Plaid is making it easy for consumers to buy cryptocurrencies. For example, if you sign up for digital asset exchange Gemini, you can use Plaid to securely connect your bank account. This simplifies the process of ACH verification so you can purchase and spend crypto sooner.

So far, Plaid has partnered with a few Crypto exchanges and investment platforms including Gemini, Binance.us, Robinhood, SoFi, and Circle (more on this soon!). They’ve also announced plans to add more crypto partners later this year.

Alain Meier, Plaid’s head of identity, spoke about these partnerships in an interview:

“Up until now, a lot of people have had separate crypto and traditional finance lives. We want to help consumers create a holistic view of their finances, so this move is especially important given that something like 60% of millennials now own crypto. …Over time, we want to help bridge that gap between Web2 and Web3 and build developer-first tooling products that can do that.”

Once you go crypto, you never go back

Since Plaid has started dipping its toes into the wild & wonderful world of crypto, what will come next from the companies that managed to connect FinTech to TradFi through APIs? In the coming years, I think you’ll see Plaid in the headlines much more for the following reasons:

Continue to integrate with more exchanges.

Continue to bridge TradFi to crypto through USDC

While points #1 & #2 above are more straight to the point and can be facilitated through direct integration partnerships, let’s dive a little bit into point #3.

How Plaid works with USDC & EUROC?

Plaid has been with cryptocurrencies like USDC since 2021 when Circle integrated with Plaid to make it easier for customers to use ACH payments with Plaid’s rapid account verifications (see flowchart below for more details):

The front end of the process is taken care of since Plaid already did the upfront work of building relationships with the major places where people hold their money. And just like they connected those places to the world of FinTech, they are starting to do the same for crypto.

Imagine a world where, through a simple API connection, money can freely flow between dollars in your bank account and digital dollars like USDC or EUROC. Once you settle in your preferred stablecoin, you have a faster, safer, and more efficient way to send, spend, and exchange money globally.

In his essay, ‘Circle & USDC: Building a Stable Platform’ Packy McCormick states:

“At the same time, I don’t think that stablecoins will replace banks or fintechs. Sometimes, they’ll co-exist. Increasingly, as is already happening, fintechs will build smoother, faster, cheaper, more global products on USDC rails, and provide the necessary guardrails, compliance, interfaces, and all sorts of other things that fintechs do best.

And it won’t just be fintechs. As money and banking become embedded in more of the products we use every day, and new categories of products are created with new technologies, I expect that USDC will be a core piece of more and more companies’ tech stacks.”

Plaid will be the bridge and Circle will be the bedrock of crypto. Which makes even more sense now that Circle has enabled USDC interoperability for developers with the launch of the ‘Cross-Chain Transfer Protocol’.

This new initiative essentially improves liquidity and efficiency for USDC throughout the crypto ecosystem, opening up new opportunities for developers to build user-friendly cross-chain apps

The bridge to the moon

Some say Plaid spawned the “beginning of fintech’s first infrastructure phase”. Their early innovations give it a headstart in becoming a critical infrastructure for all modern iterations of our financial systems. Crypto, DeFi, the Metaverse, and Web3 all come with hopes of building a better and more inclusive world, but we still need a bridge to get there.

And thats where Plaid comes in. Just like they broke onto the scene in 2013 and spent nearly a decade connecting all the traditional financial rails, we’re just starting to see the early beginnings of them doing the same across Web3, Crypto, and beyond.

Thanks for reading — until our next adventure.

Special thanks to my friend Haley Davidson for copy help & edits and mama Schroeder for additional edits (any typos are on them 😊).

Disclaimer: This month’s edition of The API Economy has no direct affiliation with Circle or Plaid. I am employed by Circle at the time of this writing. But, the views in this essay are my own personal opinions and don’t necessarily represent the views of Circle or Plaid.