Abstracting Away The Complexity Of Payments With Blockchain Technology

On building a better, faster, and more fair payment system.

Welcome to the latest edition of ‘The API Economy’ — thanks for reading.

To support The API Economy, be one of the 2,711 early, forward-thinking people, who subscribe for monthly-ish insights on the API economy, crypto, blockchains, and more emerging trends.

Payments are unhinged

It's time we take a hard look at our current payment system and imagine a better way. Blockchain technology has the potential to be that better way.

The current system is built on a labyrinth of intermediaries, each taking a cut and adding its layer of complexity. But with the advent of blockchain technology, we have the opportunity to streamline the process and cut out the middlemen. This is not just a minor improvement, it has the potential to completely revolutionize the way we think about and handle payments.

The internet made it easy to share information globally, blockchain has the potential to make it easy to transfer value globally, in a way that is fast, secure, and transparent. It's a technology that has the power to democratize finance and level the playing field.

Just like you don’t have to think about sending or receiving an email today, money will move just as freely in the future.

When I asked the internet’s favorite writer Packy McCormick of Not Boring what he thought about payments being disrupted with blockchain technology, he stated:

"It seems more and more obvious to me that an increasing share of payments will be made on crypto rails, with stablecoins leading the way. Visa’s talking about it. Mastercard’s talking about it. Stripe’s talking about it. A number of talented teams in the crypto ecosystem are working on smoothing out the bumpiest parts. Zero Knowledge Proofs will make payments more private. And done right, it’s just a smoother experience for everyone involved. It seems inevitable."

— Packy McCormick Founder of Not Boring

(Note: you can watch leaders from Circle, Mastercard, Visa, Stripe, and Checkout discuss the future of payments using public blockchain rails in this video from Converge22.)

The implications of the advancements made just in the past few years are massive and far-reaching. They have the potential to reduce costs and increase efficiency while making it easier than ever before for people to send and receive payments, regardless of where they are in the world.

Here’s a simplified overview of the steps & intermediaries involved in the current payments ecosystem.

The current payment system has been broken and duct-taped back together too many times to count. It's slow, expensive, and riddled with inefficiencies. Every time a payment is made, it goes through a series of intermediaries who take a piece of the pie and add their layer of complexity. This not only increases the cost but also slows down the process and makes it more prone to errors.

Take, for example, cross-border payments. They can take days or even weeks to clear, and the fees can be exorbitant. This is because the payment has to go through multiple banks and other intermediaries, each adding its layer of complexity and cost.

Rick Martin, Founder of crypto wallet & POS solution Decaf told me:

“We sent 1 USD Coin to Mexico and received 19 pesos, cash. This is a micro-remittance that was never before possible before blockchains.

This goes beyond just Mexico. This is going to impact those sending money home to family and friends, paying international suppliers, digital nomads, and remote workers (like myself), and those who find themselves underserved and ripped off by the current banking systems for cross-border transactions.”

Here’s an example of the process with all the middlemen that solutions like Decaf built on the blockchain can disrupt:

But it's not just cross-border payments that are affected by today's rails. Even domestic payments can take a long time to clear and be subject to high fees. The whole system is in need of an overhaul.

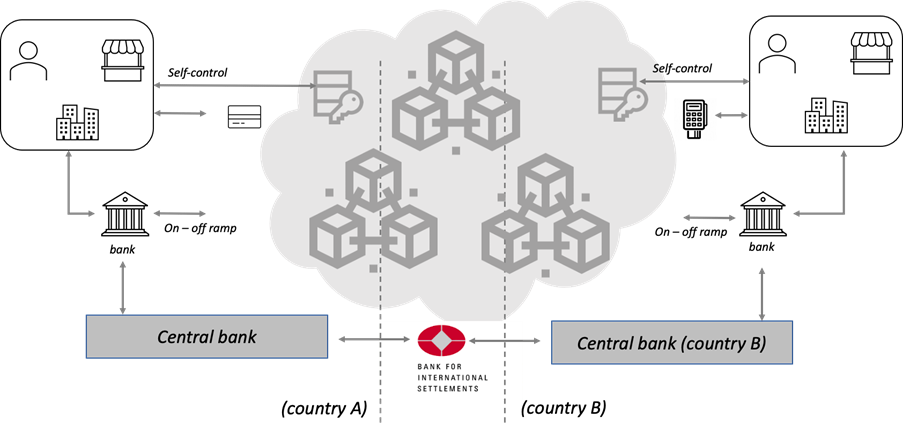

That's where blockchain comes in. By using a decentralized, peer-to-peer network, blockchain has the potential to cut out the middlemen and make payments faster, cheaper, and more secure. This is made possible through the use of smart contracts, which are self-executing contracts with the terms of the agreement written directly into the code.

With this technology, the future of payments could look something like this:

But we’re not just building towards a future state. There are real-world examples today of how blockchain technology is building the future of payments.

Stablecoins

One specific use case is the use of stablecoins (like USDC), which are digital currencies pegged to the value of a fiat currency. These stablecoins can be used to make payments and transfer value without the need for a traditional bank. This has the potential to greatly reduce the cost and time it takes to make a payment, especially for cross-border transactions.

The SWIFT system, which has long been the standard for international transfers, is being challenged by this new decentralized approach. USDC as a settlement standard is posed to completely replace the payment rails as we know them, and the shift has already started.

Recently, Cuy Sheffield of Visa stated, “We set all over Swift, so we can’t move money as frequently as we’d like because there are a number of limitations that exist in those networks. And so, we’ve been experimenting, we publicly announced. We’ve been testing how to actually accept settlement payments [with stablecoins].”

Visa, the first major payments network to settle transactions in USDC sees a future where stablecoins are the bedrock of the financial industry. To describe the benefits of stablecoins in a Twitter thread, ChainLinkGod called them a “superior form of fiat” that are:

Programmable

Permissionless

Borderless

Low-cost

Fast settlement

Interoperable

Highly liquid

The use cases for stablecoins feel infinite.

For example, the UN has already chosen Stellar & Circle to send war-impacted Ukrainians USDC as a replacement to the old method of shipping planes full of cash to places that need aid. With the use of stablecoins like USDC, we have the opportunity to streamline the process and make aid disbursements faster, cheaper, and more transparent. Here’s how it works:

Since USDC is a stablecoin pegged to the value of the US dollar, it can be easily converted into local currency without the need for intermediaries. This eliminates the need for costly foreign exchange fees and reduces the time it takes for funds to reach their destination. When recipients choose to convert to cash, whether it is dollars, euros, or local currency, they can withdraw their funds at any global MoneyGram location, including over 4,500 MoneyGram locations in Ukraine.

Because USDC is built on blockchain technology, it allows for real-time tracking of funds and increased transparency in the disbursement process. This can help to combat fraud and ensure that aid reaches those who need it most. USDC is also easily divisible (see more on micropayments below), which means that aid can be disbursed in small amounts to many recipients at once. This can make it much easier to reach individuals and families in remote and underserved areas.

On The Scoop, Nabil Manji, Worldpay's Head of Crypto and Web3 discussed the future of governments effectively disbursing money with the most impact through stablecoins:

"If you think about programable money (stablecoins). If I'm a government and I'm disbursing stimulus, can I program that stimulus program and the currency that's being allocated or distributed as part of that to only be eligible to be sent to wallets that meet a certain criteria? And once in the wallet, can the funds can only be spent on items that meet a certain criteria?"

The conversation stemmed from research Nabil mentioned which states Covid-19 unemployment fraud may have topped $45b+ (as reported by the Wall Street Journal).

Aid disbursement is one clear example of how blockchain technology is already abstracting away the complexity of traditional payments by leveraging stablecoins.

DeFi

Another use case is the use of decentralized finance (DeFi) platforms, which allow for the creation of financial instruments and services on the blockchain. These platforms can be used to create new and innovative ways of making payments and transferring value.

One of the key benefits of DeFi is the ability to create new and innovative ways of making payments and transferring value. For example, DeFi platforms allow for the creation of smart contracts that can be used to automate payments and transfer value. This can greatly reduce the cost and time it takes to make a payment, especially for cross-border transactions.

DeFi also allows for the creation of new financial instruments, such as lending platforms and yield farming opportunities. These new instruments can open up new revenue streams for businesses and increase access to capital for individuals and small businesses.

It's important to note that DeFi is still in its early stages and there are many challenges that need to be addressed. However, the potential for DeFi to disrupt the traditional financial system is enormous and it's a technology worth paying attention to.

Micropayments

Another important aspect of blockchain-based payments is the ability to facilitate micropayments. Micropayments are small, incremental payments that are typically less than a dollar.

Traditionally, micropayments have been difficult to facilitate because of the high transaction costs associated with small payments. However, blockchain technology has the potential to greatly reduce these costs and make micropayments a viable option.

With the use of blockchain technology, it's possible to create smart contracts that can automatically divide and distribute payments according to predefined rules. This can greatly reduce the cost and time it takes to make a micropayment, and can open up new revenue streams for businesses.

Micropayments can also have a profound impact on the way we access goods and services. They can be used to pay for access to NFTs & other digital content, such as articles, music, and videos. This can increase access to information and entertainment for individuals, and provide new revenue streams for content creators.

This use case is being used today by the likes of Twitter and Stripe who rolled out a USDC payout program for creators via Polygon.

A model like this is especially important for global creators, who often have to deal with high transaction fees and long wait times when receiving payments. With USDC, they can receive payments quickly and with minimal fees.

When I asked TJ who works on payments at Solana for his thoughts, he said:

“Blockchain is a new primitive that has yet to build out the rich suite of integrations we’ve come to expect within web2 softaware. There is a large opportunity in providing these companies with powerful APIs that have simple interfaces. This will increase the likelihood of delivering powerful payment transactions to consumers.”

The use of USDC also provides global creators with greater flexibility in how they receive payments. They can use USDC to receive payments directly from their fans, without having to go through intermediaries. This can greatly increase the revenue streams for creators and provide them with more control over their financial futures.

Zero-Knowledge Proofs

One of the key benefits of blockchain-based payments is the increased usage of zero-knowledge proofs, which provide a secure and privacy-preserving way to confirm the validity of transactions.

Zero-knowledge proofs allow for transactions to be verified without revealing any sensitive information about the parties involved. This is achieved by using cryptographic algorithms that allow one party to prove to another that a certain statement is true, without revealing any information about the statement itself.

In the context of blockchain-based payments, zero-knowledge proofs can be used to validate transactions without revealing the identities of the parties involved or the details of the transaction. This makes blockchain-based payments more secure and private, as it eliminates the need to trust intermediaries to handle sensitive financial information.

Over the next decade, zero knowledge has the potential to be one of the biggest breakthroughs of our lives.

To quote Packy McCormick for the second time, he states in Zero Knowledge:

“Every so often, a technology comes around with the right combination of promise, nebulousness, inscrutability, and abstractness to fully capture and incept the hive mind’s imagination. These technologies aren’t just going to change a few things; they’re going to change everything.”

I guess you guys aren’t ready for that yet. But your kids are gonna love it!

In Back to the Future, Marty McFly plays Chuck Berry’s “Johnny B. Goode” and is met with silence from the crowd, but one person in the crowd is on their phone saying that this music is the future. In a similar vein, blockchain technology has the potential to revolutionize the way we think about and handle payments, we are just early in our journey.

Payment costs will be driven down to next to nothing, money will be programmable & composable, and value will be transferred as easily as it is to move as data today.

It's time for us to embrace blockchain technology to build the future of payments.

Thanks for reading — until our next adventure.

Special thanks to mama Schroeder for additional edits (any typo is on her 😊). Also, thank you to Packy & Dan of the Not Boring crew for quotes & edits, Rick Martin of Decaf for comments, and TJ at Solana for his comments & feedback.

Disclaimer: This month’s edition of The API Economy has no direct affiliation with Circle or any other company mentioned. I am employed by Circle at the time of this writing. But, the views in this essay are my own personal opinions and don’t necessarily represent the views of Circle.