Circle: Finance Built For The Digital World

The company on a mission to raise global economic prosperity through the frictionless exchange of financial value.

Welcome to this month’s edition of ‘The API Economy.’

Be one of the curious, forward-thinking people, to subscribe to this newsletter for monthly insights on APIs, Crypto, Web3, and other emerging areas.

Hello everyone 👋,

Disclaimer: This month’s edition of The API Economy has no direct affiliation with Circle. I am personally joining the Circle team and wanted to document some of my thoughts on the company. This is simply a culmination of my learnings from the outside looking in at a company I just joined. The views in this essay are my own personal opinions and don’t necessarily represent the views of Circle.

About Circle: Circle has built USDC, a stablecoin cryptocurrency that has been growing faster than any other digital currency in the world.

In this edition of The API Economy, I’ll cover:

Why the work Circle is doing matters.

What Circle is building (including USDC & more).

Where USDC is positioned in the stablecoin market.

What Circle is doing for cryptocurrency and stablecoin regulation.

Now, let’s explore Circle.

Circle was founded on a belief that its inevitable blockchains & digital currency will replace the current global economic systems, creating a fundamentally more open, inclusive, efficient, and integrated world economy. Much like electric cars will replace gas & diesel cars completely, the way we transact physically will be replaced by digital transactions.

They envision a global economy where people and businesses everywhere can more freely connect and transact with each other, through a system that has the reach and accessibility of the internet & knows no borders or boundaries. CEO & Founder Jeremy Allaire likes to depict the friction between financial systems by comparing them to emails saying, “you don’t send cross-border emails, you just send an email to a trusted counterparty.”

So what happens when finance becomes flat and you’re not sending cross-border payments, you’re not relying on intermediaries, and money becomes composable?

Such a system will raise prosperity for people and organizations everywhere.

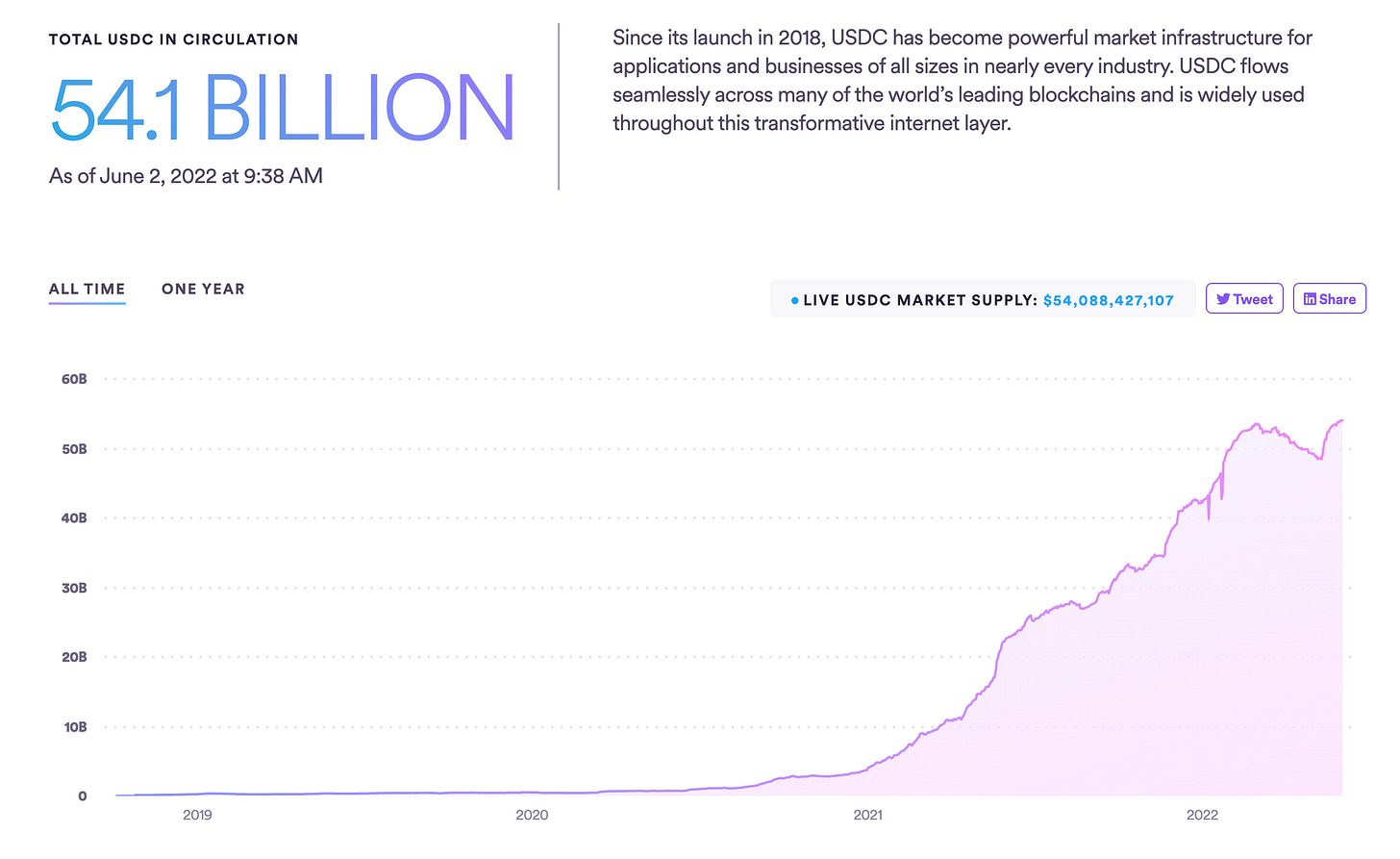

And the hopes of creating programmable money to fuel global economic prosperity are long past the concept phase and have taken shape through the popular stablecoin USDC created by Circle. Since USDC’s inception in 2018, the demand has soared, and grown the total supply to over $54 billion (as of June 2nd, 2022.)

Circle started with a US dollar-backed stablecoin (USDC) because as Naval Ravikant notable crypto thought-leader and founder of AngelList said on the Tim Ferris podcast, “the entire world uses the US dollar as its stable currency (as its ultimate stablecoin).” The global faith in the US dollar makes it the perfect peg for a regulated stablecoin that runs on blockchain technology.

USDC has become a backbone of crypto capital markets, where blockchain-based “smart contracts” eliminate the need for traditional intermediaries and automatically match buyers, sellers, borrowers, and lenders, opening financial access to more people.

With such an aspirational vision, monumental traction, and strong leadership – a few of the most notable funds in the world are opting to back Circle. Investors including BlackRock, Fidelity Management and Research, Marshall Wace, and Fin Capital all participated in Circle’s most recent $400 million funding round.

So why is USDC growing in popularity and why are investors so bullish on Circle?

Infrastructure the internet needs

At the heart of an optimist (myself), blockchain technology represents the idea that sharing value will become as easy and frictionless as the internet made sharing information. Building out a seamless exchange of value on the internet is one of the foundations needed to support the mainstream adoption of Web3.

Web3 is a term that gets used a lot, but I wanted to briefly share a definition I like to use to portray why Web3 is so revolutionary.

In an HBR article, Jad Esber and Scott Kominers define Web3 as being built differently than the internet we know today. It’s based on the premise that there’s an alternative to exploiting users for data to make money — and that instead, building open platforms that share value with users directly will create more value for everyone, including the platform.

USDC is one of those platforms. Discussing its potential in the essay Designing Token Economies, one of my favorite writer/advisor/VC/Twitter celeb Packy McCormick of Not Boring states,

“Imagine being able to create any economic and governance model that currently exists, with additional features made possible by programmable money, code-based laws and enforcement, and composability. There are trade-offs, of course – decentralization can mean slower decisions, bugs in code are exploited quickly, and many more. But we believe we’re just at the very tippy top of the iceberg. The wildest ideas are yet to come, but they’re about to.”

All this is now possible because of the technology built in tokens like USDC.

Jesse Walden, founder of The Variant Fund and former a16z advisor portrays tokens in a light that shows just how powerful they are claiming, “Tokens are an innovation that are (kind of) akin to data packets in that they’re a standard way of moving bits of value just like we move bits of information. And that is very granularly, instantly, to anyone, anywhere in the world. So what that means is it’s now possible to distribute value to users of internet platforms at scale.”

And the programmability of these tokens is what makes them so powerful. Thousands of developers are taking advantage of USDC's open-source smart contract to build the future of commerce. In addition, developers can integrate their apps with Circle APIs to accept both fiat and USDC payments, automate payouts, embed digital-asset accounts infrastructure into their product or service, and power their internet marketplace.

Circle’s approach to building around USDC

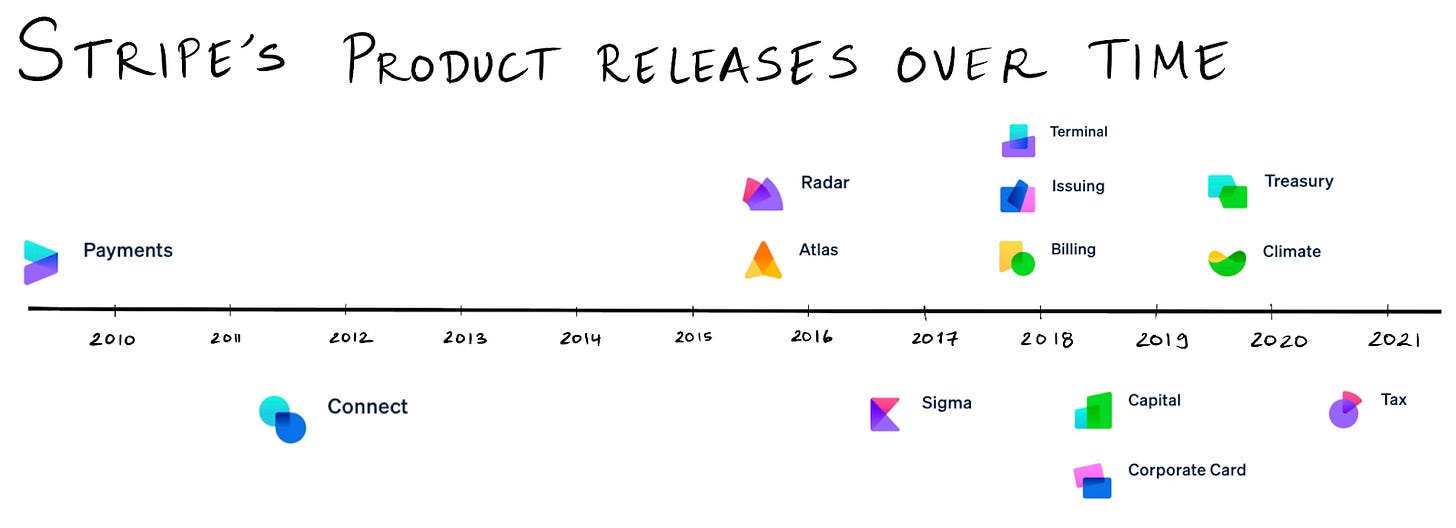

I like to think about Stripe and its early focus on payments. In their first five years as a company, Stripe only released two new products. But in the five years to follow, it built the foundation for them to launch ten new products which all supported or grew its core business of payments.

In a press release for their treasury product, Stripe’s Co-Founder and CEO Patrick Collison stated, “We are still very early in developing the set of Stripe products beyond the core payments engine, things like Treasury.”

Stripe, one of the most successful SaaS companies of this generation after 10+ years of building around payments still feels like they are ‘early’. And if Stripe is still early, then Circle is just getting started.

From the outside looking in, Circle seems to be taking a similar strategy to Stripe with their product release & acquisition strategy to focus on building around USDC. They are highly incentivized to support and grow the demand for USDC similar to how Stripe has done for payments.

I imagine that Circle will innovate in other stablecoins beyond USDC for other countries’ currencies, but the tip of the iceberg is growing and evangelizing USDC.

To grow USDC demand to date, Circle has:

Launched Circle Yield to enable crypto-based investment that is fully secured by bitcoin collateral and earn higher yield compared to traditional bank rates and many fixed income markets. Circle Yield is built with USD Coin (USDC), the leading dollar digital currency.

Launched Circle APIs to create differentiating experiences for organizations with the leading dollar digital currency, powerful account infrastructure and seamless access across the world’s leading blockchains and traditional banking rails.

With a company like Circle, the added internet functionality it provides users will (and already is) lead to mass market adoption from a consumer perspective. As Ben Thompson describes ‘Aggregation Theory’:

“No longer do distributors compete based upon exclusive supplier relationships, with consumers/users an afterthought. Instead, suppliers can be commoditized leaving consumers/users as a first order priority. By extension, this means that the most important factor determining success is the user experience: the best distributors/aggregators/market-makers win by providing the best experience, which earns them the most consumers/users, which attracts the most suppliers, which enhances the user experience in a virtuous cycle.”

When the market starts to demand the support of USDC more universally (like has already happened with most crypto exchanges & NFT platforms), then businesses have to catch up and leverage Circle’s APIs to support USDC to provide the best user experience.

We’re already starting to see some innovative use cases emerging with people building on top of USDC. Some examples include:

While I’m optimistic about the future at Circle, I’d be remiss if I didn’t touch on the risks with stablecoins.

Stability for a volatile market

In the past few weeks, we’ve had time to digest the downfall of LUNA/UST. In a recent article on, ‘MoneyGram CEO Sees a Future in Stablecoin Remittances’

This month’s collapse of the TerraUSD stablecoin has put an unfavorable light on these kinds (stablecoins) of digital assets and triggered market instability. Even though Terra is different from USDC, which is backed by dollar-equivalent assets kept in reserve, the Terra meltdown has raised concerns that these stablecoins could lose their peg too.

USDC differs from UST and other stablecoings, as it is collateralized by assets, whereas the latter relies on incentive-based algorithms powered by Terra’s cryptocurrency LUNA to maintain its peg to the U.S. dollar. Collateralized stablecoins like USDC have mostly maintained their peg to the dollar during all the market turmoil.

The crash of UST helped the broader market realize:

Stablecoins need to be able to withstand extreme market volatility

We need a reserved regulated model for digital dollar stablecoins

On the regulations of stablecoins and other cryptocurrencies Naval Ravikant has stated, “unfortunately, we’re trying to apply laws that are almost 100 years old to try and regulate this incredible explosion in internet commerce, market making, and digital private property.”

Luckily, Jeremy Allaire, Dante Disparte, and the Circle team have been at the forefront of stablecoin and crypto regulation and we all hope to get more clarity from the government this year. On ‘The Money Movement’, Jeremy stated: “There’s no regulator in the world that can keep up with the pace and innovation that’s happening with programmable money on the internet.” This is why Circle continues to be so instrumental in guiding regulators on how to properly regulate stablcoins.

Packy M brilliantly notes again in ‘Designing Token Economics’, why governments are incentivized to get these regulations right and to do it quickly.

“In “Why Nations Fail,” economists Acemoglu and Robinson study the patterns of wealthy countries and developing countries. They observe that developed countries are wealthy because of “inclusive economic institutions” vs. extractive institutions.

Countries that have what they call “inclusive” political governments — those extending political and property rights as broadly as possible while enforcing laws and providing the public infrastructure — experience the greatest growth over the long run. By contrast, countries with “extractive” political systems — in which power is wielded by a small elite — either fail to grow broadly or wither away after short bursts of economic expansion.

These lessons should be taken seriously when designing crypto networks. Through the lens of development economics, the need for decentralizing political and economic power aligns well with blockchain networks’ very own design. A blockchain network’s value is largely dependent on the quality of “natural resources” (blockspace and gas) and demand for the network’s goods and services. The United States, too, is largely dependent on the quality of its l resources: its infrastructure, people, and natural resources. But good policy matters too, especially when it comes to coordinating people.”

Closing thoughts

On the Tim Ferris podcast, Chris Dixon, Partner at a16z said:

My definition of Web3 is it’s an internet owned by users and builders orchestrated with tokens. This new concept of a token is the kind of the key concept of Web3.

Building on an interoperable infrastructure layer (or a token) makes it easy for platforms to plug into broader networks, expanding the scale and types of value for users. The internet and the world as a whole can truly become a better place through the frictionless exchange of financial value that focuses on 3 pillars.

Trust

Composability

Programmability

Circle is building critical infrastructure around these pillars to improve global models of trade and commerce, integrate the world’s economic systems more deeply, and allow for creativity to flourish in how economic arrangements bring growing prosperity to everyone in the world.

And I can’t wait to be a part of it.

To stay up to date on all things Circle & USDC, subscribe to their newsletter.