Why The Fastest-Growing Economic Actors Aren't Human

Agents have learned how to act on their own. What comes next will happen faster than anything we’ve seen before.

Welcome to the latest edition of The API Economy. Thanks for being here.

To support the API Economy, join the 11,420 early, forward-thinking people who subscribe for insights on the forefront of technology, crypto, AI, and other emerging trends.

This weekend marked a clear inflection point in our understanding of AI agents.

Across X, people have begun to share examples of AI agents being spun up in large numbers and immediately put to work. Agents browsing the web, writing and deploying code, coordinating with other agents, monitoring markets, and taking action without ongoing human input.

People began to see what agents are capable of through tools like OpenClaw, Bankr, and moltbook.

Many of these agents are no longer confined to internal systems. They are increasingly connecting to external services like APIs, blockchains, cloud infrastructure, and markets. Once connected, they operate independently.

People are noticing that when an agent finds a useful path, it could be duplicated instantly. When conditions changed, agents adapted without waiting for human review. Learning propagates as fast as computation allows.

For example, someone’s Clawdbot got his developer’s number from Twilio, connected the ChatGPT voice API, and waited for him to wake up to call him.

As more people shared real examples over the weekend, it became clear that a growing share of software will now be designed primarily for other software and agents to use. Humans define objectives and boundaries, but the execution belongs to machines, and products need to be optimized for agentic use cases.

That realization set the stage for the next conversation. If agents are becoming economic actors, the rails they choose matter. This matters because the number of economic actors on the internet is about to explode.

A human can run a few workflows at once. An agent can run thousands. And once the cost of spawning an agent drops low enough, quantity becomes the product.

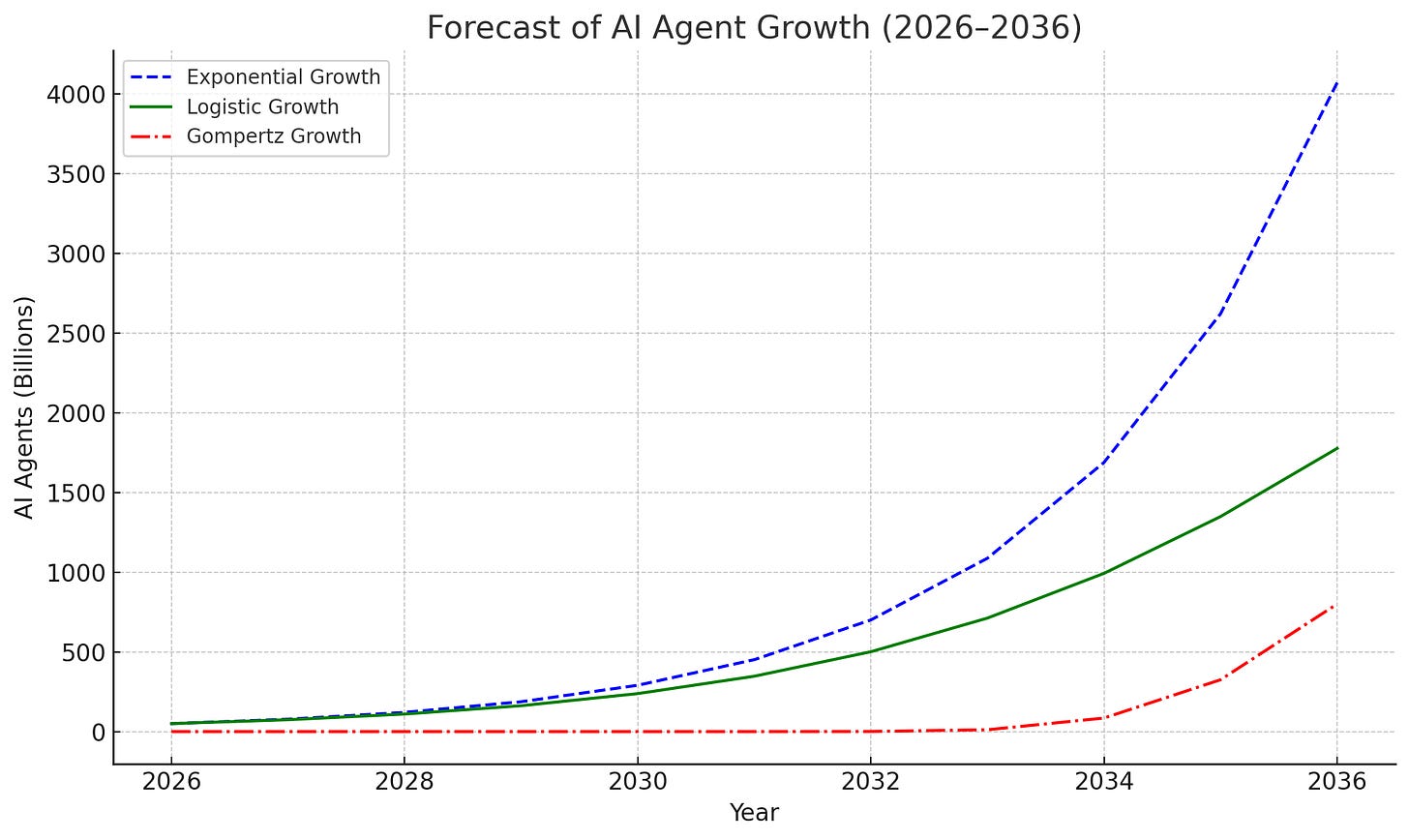

There is now published modeling work that treats agent proliferation as a scaling curve that can reach multi-trillion agent levels under plausible adoption dynamics. One recent paper on arXiv explicitly discusses models that approach a multi-trillion-agent scale, with growth that accelerates mid-decade and then slows as infrastructure becomes the bottleneck.

Trillions of agents will result in quadrillions of transactions. When trillions of agents exist, the economy changes in three concrete ways:

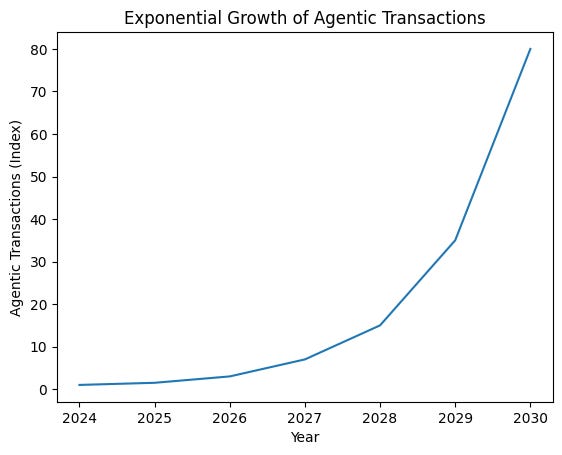

1) Transaction volume goes vertical

Agents transact in loops. They pay, verify, retry, and route around failures. They negotiate. They coordinate. They split tasks across other agents. This creates many small payments (microtransactions) instead of a few big ones.

Even before “trillions of agents,” research by McKinsey projects that agents will mediate $3T to $5T of global consumer commerce by 2030.

2) Money becomes an API

At agentic scale, payment methods that require human steps become a bottleneck. Agents need:

Always-on settlement

Programmable rules

Global reach

Low fees for small payments

Instant verification

When the “default customer” becomes software, the “default money” trends toward programmable dollars.

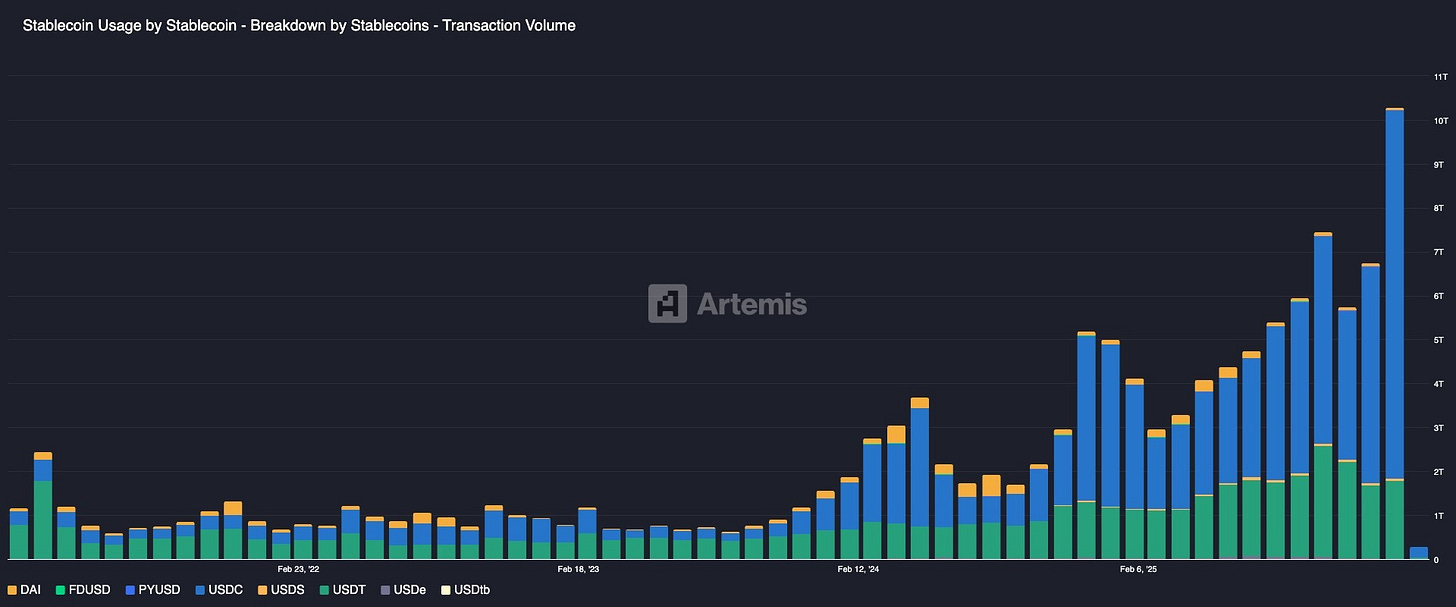

This is where stablecoins win, especially USDC on blockchain rails in the current discourse. Agents optimize for reliability and integration, and stablecoins behave like digital cash that software can move and settle without waiting on institutions.

Stablecoins in January of 2026 alone surpassed $10 trillion, a number that will rise exponentially with the addition of an economy of agents.

3) Entire new markets appear: agent labor, agent-to-agent services, agent finance

Trillions of agents transacting means the economy becomes more granular. You get markets priced in fractions of a cent through:

Pay-per-query data

Pay-per-inference tools

Pay-per-action automation

Micro-insurance for execution risk

Escrowed performance payments

Automated auditing and compliance

You also get new failure modes:

Runaway spending loops

Adversarial agents extracting value

“Agent flash crashes” in markets with reflexive automation

This pushes demand toward identity, permissions, and risk controls built into the rails. All these components compound faster than prior tech waves because agents replicate. Instant replication abilities lead to:

Better models make agents more capable.

More capable agents produce more software, content, and coordination.

That output is used to build better agents and spin up more of them.

Once the economy’s fastest-growing participant is software in the form of agents, the economy starts to reorganize around it. And only a matter of time before agents outpace people participating in the global economy.

Every product should be thinking about how agents and, more broadly, AI can access, use, and benefit from it. This next part will happen fast. It’s time to get ready.

Until our next adventure.

Disclaimer: This month’s edition of The API Economy has no direct affiliation with Circle or any other company mentioned. I am employed by Circle at the time of this writing, but the views in this essay are my own personal opinions and don’t necessarily represent the views of Circle.

*Special thanks to Mama Schroeder for editing this essay (any typos are on her 😊).