The Next Platform Shift in Fintech

Every fintech in the world will adopt stablecoins.

Welcome to the latest edition of ‘The API Economy’ — thanks for reading.

To support The API Economy, be one of the 9,556 early, forward-thinking people who subscribe for monthly-ish insights on the crypto, stablecoins, AI, and more emerging trends.

Today’s essay is a guest post written & published by Juan Lopez, Partner at VanEck Ventures & lightly edited by Peter Schroeder.

Stablecoin networks will play a pivotal role in the next era of Fintech, particularly in (i) payment for goods & services and (ii) asset origination and management.

By creating open, disintermediated liquidity and customer acquisition networks with revolutionary market expansion potential, stablecoins and public blockchains enable financial products to tap into internet-scale distribution with a single API on day one.

Removing friction in payments has historically driven economic growth. From Lydia's standardized coins enabling Mediterranean trade to medieval bills of exchange creating global commerce, simpler exchange of value expands markets.

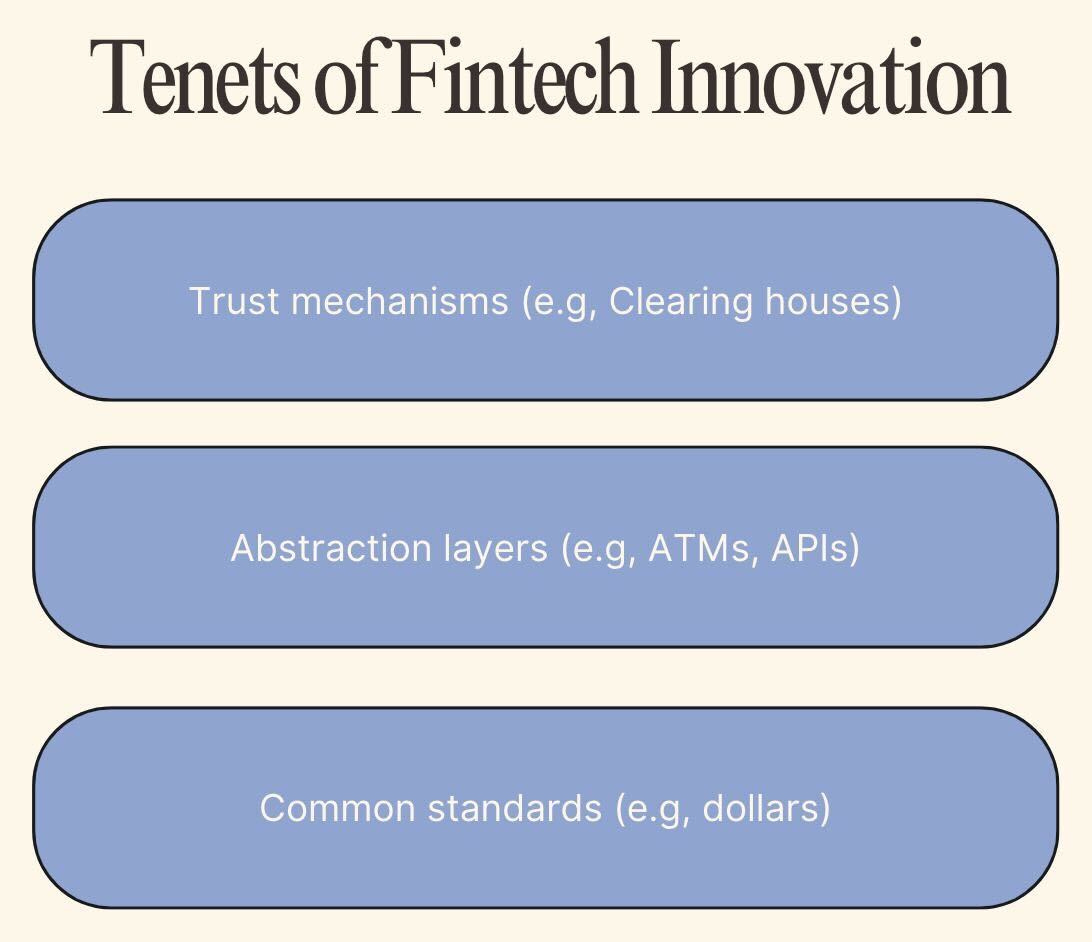

We’ve come a long way. From shells to digital wallets, innovation in payments has continuously reshaped commerce. This past decade in fintech showcases this through credit card networks, India's UPI, Brazil's Pix, and Kenya's M-PESA. The search for innovation has typically been built upon three core tenets:

Common standards that align economic incentives, like the dollar as a shared medium of exchange, enable predictable market interactions.

Abstraction layers enhance utility while containing risk—from banking APIs to fraud prevention systems that shield users from complexity.

Network-based trust mechanisms - such as clearing houses that ensure transaction finality or provide recourse when needed.

These core principles typically build upon each other, allowing breakthroughs in trustless settlement to spark innovations in economic alignment and vice versa. Public blockchains enable a global platform for developers to innovate around these principles in the open to build products like stablecoins.

This has set the stage for the next platform shift in Fintech: The rise of open-source banking and financial services powered by global, trust-minimized stablecoin networks like USDC, USDT, AUSD, and more.

While stablecoins present an enormous opportunity, we need to understand both their potential and limitations. In this piece, I'll cover:

The unique capabilities stablecoins unlock for financial services.

How the market is evolving from simple issuance to full-stack infrastructure.

What this means for the next generation of Fintech giants.

The Big Unlock: Open Source Banking-as-a-Service

While peer-to-peer payments over blockchains like Solana or Base today are nearly free, the cost of abstracting crypto complexity while managing risk and compliance is largely externalized from the low fees that lure us into the opportunities across B2B and consumer payments. The cost of transferring USDC on Solana from wallet A to wallet B might be a fraction of a penny, but compliance costs will eventually have to be added back into the equation.

If you use apps like Sling or DolarApp to send/spend money around the world, the benefits are clear. However, the unit economics are likely not 10x improvements over traditional rails. The truth is that the cost of running stablecoin infrastructure at scale offsets some of the benefits of instant settlement and programmability. I generally agree with Simon Taylor, who recently stated that Stablecoins' advantage isn't primarily about cost – it's about better infrastructure.

Lower fees alone won’t drive mass–scale adoption. Despite being 60–80% cheaper and faster with dramatically better UX, major fintech platforms like PayPal and Wise currently handle less than ~3% of global payments volume and about 20-25% of consumer cross-border flows when comparing 2023 public filings for Paypal, Airwallex, Wise, Western Union, and others to FXC’s market research.

The real innovation is stablecoins' open-source infrastructure, which enables developers to build unique applications and iterate faster than ever before. By lowering the barriers to entry, emergent properties arise and deliver unpredictable results.

For the first time, we have a global standard for programmatic value transfer with growing accessibility & composability irrespective of the way users access their money (it’s worth noting even ecosystems like Paypal and Venmo have been unable to facilitate “internal” transfers until stablecoins). Smart contract-based money introduces a new level of utility for developers, from basic conditional payment execution and collateralized lending to yield streaming and programmable compliance executing over the same open infrastructure.

How valuable is this? We could consider proxies like the $13T+ Eurodollar market or even the current TAM of all global payments. I bet it can be bigger than that.

A Harvard Business School study estimates the economic impact of open-source software is ~$8.8 trillion. My bet is this figure changes materially when taking public blockchain financial infrastructure into account. By sharing costs across a global platform (of forkable contracts, nodes, developers, users, etc.), stablecoins and public blockchains meaningfully expand the addressable market of all payments and capital markets.

As we’ve seen in prior technological shifts like the Internet and Cloud, disruption is inevitable but won’t happen overnight.

For example, the opportunity in commerce and merchant services will be harder to crack due to consumer affinity for credit. In fact, it’s quite likely Visa and Mastercard (perhaps Stripe + Bridge) end up being some of the long-term winners in stablecoin orchestrated commerce due to their strong merchant distribution and incentive structure. To date, the winners have been the stablecoin issuers, but the future holds potential for many more winners.

Beyond Issuance: A Tale of Float vs. Flow

The stablecoin space is already fiercely competitive and dominated by players with strong distribution. Issuers like Circle and emerging stablecoin payment service providers (PSPs, e.g. Bridge) are scaling rapidly. Meanwhile, fintech and banking incumbents (Stripe, Robinhood, Paypal) are ramping up their efforts. The opportunity to redesign payments and rebundle financial services has taken center stage, as pure-play fiat-backed USD stablecoin issuance is quickly becoming hyper-competitive.

As we get regulatory clarity, perhaps soon via the GENIUS Act, and enable the U.S. banking sector to interface with crypto more broadly, the winners here will not just issue stablecoins but build complimentary services around them. Plenty has been written on this topic as it pertains to stablecoin banking—I particularly enjoyed this piece by Bridget from Founders Fund.

It’s no surprise that stablecoins are on the agenda of every major Fintech boardroom. Discussions around build vs. buy strategies are already well underway, and we’ve seen Fintech giants like Paypal, Robinhood, Nubank, and Revolut all exploring stablecoin strategies in 2024 alone. What exactly are they looking to enable?

1️⃣ Crypto Capital Markets

Historically, the first key use case for stablecoins to achieve product-market fit has been denominating crypto capital markets in dollars.

To service this, issuers (Circle, Tether) have captured value by maintaining a “float” and building products and services (e.g. mint/burn, CCTP) that extend stablecoin utility and sustain network effects.

We’re already seeing issuers begin to (a) build complementary SaaS businesses via developer infrastructure and/or (b) monetize transaction flow via their own chains/payments platform in order to differentiate.

However, It’s interesting to see how this concentration of value as net interest margin for the large stablecoin issuers has led to opportunities being created elsewhere.

Keith Rabois mentioned this in a recent All-In pod:

"The art to me is because everybody's now a node connected into these crypto networks...can you build an application on top that would have too much inertia, too much friction to start from scratch, but it has real value? And I think it's possible because so many people are now connected based upon speculation initially."

The incentive behind float-based stablecoin businesses has catalyzed open-source dollar liquidity networks around the world. These networks are evolving beyond simple money movement and becoming foundational for broader financial applications.

2️⃣ Tokenized Financial Products

Stablecoins transform consumer access to financial products. Conversely, they transform how asset originators can reach consumers at scale.

Starting with basic dollar access in high-inflation markets (through platforms like Littio in LATAM), stablecoins have created a 30M+ address open-source distribution network for financial products.

This network addresses two key inflections:

Stablecoins on public blockchains enable global access to dollar-denominated yields and financial products

Tokens and smart accounts lower the cost of servicing mass-scale financial products. Vlad Tenev elaborates on this in his recent op-ed.

To illustrate, Ethena now offers institutional-grade, dollar-denominated funding rate arbitrage yield to any user worldwide - a strategy previously limited to prop desks and hedge funds. In under a year, it has grown to hundreds of thousands of users and $6B+ in AUM (as of February 2025).

As more users leverage stablecoins (whether they know it or not), we'll see increased competition to serve a global user base with more sophisticated financial products (via protocols like Concrete and Superform or tokenized assets like Truly), making stablecoins the de facto standard for global financial product distribution. I think this is the key inflection driving Circle to acquire Hashnote.

Whether users want dollar yield to begin with no longer matters. Competitive dynamics over who gets to monetize other opportunities have introduced incentives to retain users on-platform (see Nubank’s latest announcement, for example).

Similarly, there is a broader opportunity to make the world’s most valuable assets programmable and tradeable in a compliant manner. We’re excited to see more compliance-first teams like Dinari come to market as a platform for regulated securities to trade on-chain.

The natural conclusion here is that more sophisticated product offerings previously accessible only by select individuals/institutions will become available to the masses through blockchains as the most scalable distribution channel. The same applies to payments.

3️⃣ Collapsing the Payments Supply Chain

For a primer on how stablecoins enable instant payments worldwide and how they disrupt the correspondent banking system, Kunle offers great perspective in his January piece. I also recently enjoyed Matt Brown’s piece, Stablecoins in 1000 words.

As noted above, crypto capital markets activity has driven dozens of infrastructure players to create fiat endpoints connecting to local crypto exchanges. This has created a stablecoin liquidity network that is now serving various payment verticals, predominantly global consumer dollar accounts, “offshore” dollar bank accounts, and cross-border payments.

Dozens of venture-backed consumer and business applications are now leveraging this infrastructure to orchestrate payments at a global scale.

Stablecoins' impact on global payments is already significant, having settled ~$30T in transaction volume in 2024. We often compare this to Visa’s transaction volume, but when accounting for bots, high-frequency trading, and other distortions unique to public blockchains, only about ~20% of this really counts as organic activity. While not an apples-to-apples comparison, the industry has come of age as a payment medium and settlement layer, a mix between Visa and the DTCC.

We often reference this chart of growing USDC<>MXN remittance flows via Bitso. What’s interesting is that most of the stablecoin settled remittance flow in this particular corridor is actually happening off exchanges (as exchanges are not in a place to lower their take rates – though it’s hard to track). We should expect to see this occur on a global scale.

This surge in activity is causing stablecoins to increasingly deepen their connectivity in and out of global fiat economies to power global money movement. Based on our own discussions with most of the firms enabling this, we estimate stablecoin-to-fiat channels already facilitate $30-80m in daily remittances across US-India, Africa, APAC, and Latin America corridors.

Two key developments monumental for money movement will accelerate this:

Open liquidity networks will soon offer best-in-class FX across all major corridors. For example, see Circle’s partnership with BTGPactual. This eventually enables USD/BRL wholesale FX rates at internet scale. On-chain markets will have access to prime FX institutional rates (vs. retail rates) as dollar stablecoins connect to the largest banks in each jurisdiction. This will likely become the foundation for on-chain FX markets.

P2P payment orchestration by non-bank actors around the world powered by smart accounts and stablecoins as the default stack. This will introduce the re-bundling of payments as near instant and table stakes in most applications. Much of this is already happening today without stablecoins– Uber, Lyft, Instacart, and many others monetize “time-to-money” in a world where t+3 settlement and bi-weekly paychecks are the norm. Stablecoins will unlock this capability for any developer, thus lowering working capital requirements.

Think of stablecoins as creating a universal adapter for money. By aggregating the deepest liquidity from USD to any asset/currency and becoming the de-facto developer platform for fintech applications, the stablecoin economy strengthens through a self reinforcing cycle.

But many questions & misconceptions remain.

Many assume that success for stablecoins is dependent on their ability to off-ramp to settle with merchants. Baking in fiat on/off ramp fees and compliance complicates the unit economics of stablecoin payments in the short term.

But perhaps stablecoins can become the standard, removing the need to on/off ramp.

This leads to more questions (and some speculation). As we bring more stablecoin settled activity on-chain and a wider basket of currencies, what will be the role of traditional payment messaging systems and banks? What will be the role of cash exchange houses or cash remittance players? I’m not suggesting they go away, but they’ll likely play different roles.

“peer-to-peer” infrastructure for non-bank actors to offer payment products and services without directly relying on banks is here. We will still need custody and redemption mechanisms for fiat, but transactional value likely moves on-chain. However, it’s unclear how long this form of regulatory arbitrage will remain.

The last mile problem we had a few years back is already largely solved through platforms like Rain and Reap which enable any application to provide a global dollar account you can spend from anywhere Visa is accepted. This is touching the lives of millions today by enabling remittance recipients to spend instantly.

The above is further enabled through what we are now calling “stablecoin PSPs”. There are now >40 infrastructure players who manage both traditional fiat accounts and stablecoin liquidity in different parts of the world. They are all competing to offer a growing set of platform services: smart settlement credit facilities, wallet infrastructure, cards and spend management, compliance-as-a-service, and much more.

Banks will remain important for custody and redemption, but the design space for non-bank actors to build on open multi-currency rails will radically transform money movement.

Soon, we’ll see stablecoin adoption beyond cross-border consumer remittances as we get more regulatory clarity and validate new business models beyond stablecoin issuance. As the benefits of programmable money meet improved FX spreads, ERP integrations, fraud & risk tooling, confidentiality, and more. One of the largest opportunities lies in B2B payments (~$150T market), where stablecoins can enable the next generation of:

Treasury management systems, enabling auto-repatriation, FX hedging, in-house banking, etc.

Cash flow management via settlement-agnostic invoicing with smart escrow, auto currency conversion, and open secondary markets for trade finance and invoice factoring.

Pricing models, Accounting, and reporting automation via transaction enrichment and open payment data markets (e.g. via Loop) plugging into ERP systems.

This moment in time marks the end of the on/off ramp, where we detract from thinking about the opportunity as onboarding and offboarding from crypto stablecoins.

End-to-end payments of all types are the opportunity.

We now covered how stablecoins provide a superior open platform for moving money and assets globally– thus powering the next wave of Fintech innovation.

Now, let's explore what the next wave of winning players could look like.

The Next Fintech Giants

The rise of Fintech players like Nubank, Revolut, Stripe, and Robinhood demonstrates the power of superior distribution in financial services. What they've achieved with limited infrastructure is remarkable - and notably, all are now running blockchain-powered products.

While blockchains offer compelling infrastructure, distribution - not technology - remains the primary challenge for new entrants. One too many founders assume they'll win off the back of stablecoin and crypto adoption alone but will be faced with a reality check: Most high LTV target users already have access to banking and basic financial services.

This could change. But "Banking the unbanked" or “Onboarding the next billion users” overlooks that building highly profitable mass-scale businesses will require more than just better technology—it demands a compelling reason for users to switch. This is especially true for businesses where existing financial workflows are deeply embedded and difficult to displace.

There are notable examples of companies that see this as an opportunity. Start-ups who are providing globally scalable financial services on superior infrastructure to users in multiple markets and seeing impressive growth in their respective business and consumer segments:

DolarApp, Lemon, Belo, and Littio are leading consumer adoption of stablecoins in LATAM, resonating with an audience that wanted simpler and cheaper, dollar banking products.

Sling, FelixPago, Abound, Afriex, AirTM lead in servicing more globally connected economies by enabling seamless remittances for consumers from U.S to LATAM, India, and Africa.

Bridge, Conduit, Rail, Loop, Harbour, Koywe, Acctual, Ridian, and Rain are some of the most exciting teams we’ve met that equip businesses with the infrastructure needed to orchestrate and spend off stablecoin balances while extending their connectivity to the world’s financial systems.

The common trend we observe is that the next Fintech unicorns won't win solely through token incentives or by building over the next trending blockchain ecosystem. They'll win by placing emphasis on:

Long-term monetization of both float and flow.

Design and building products uniquely feasible via programmable money.

Targeting non-consensus niches or tapping into a unique insight with massive growth potential.

Built-in virality and low onboarding friction (big fan of Tiplink).

Operational excellence, leveraging open-source infrastructure to ship 10x faster. For example, using blockchains as a global computing platform not only shares the cost of money storage and movement but also risk and compliance

So, where do we go from here? The next 10x unlock comes from clear regulation and infrastructure enabling more complex, regulated use cases. Tools acting as middleware solving for compliance, smart onboarding/account management, fraud prevention, and KYC/AML will be key for bringing regulated flows on-chain.

Some companies building critical infrastructure to enable this include:

Rhinestone. A robust smart account module ecosystem will lead to smooth onboarding flows, embedded wallet experiences, and unified cross-app experiences to become the norm. For example, by enabling cross-margining between certain on-chain trading venues.

Predicate. My general hunch is that user experiences will become radically simple while the underlying orchestration smart contract applications will need to build will become increasingly complex to accommodate various legal/compliance/regulatory requirements. To translate this into smart contract code, developers will need a policy orchestration layer enabling them to seamlessly call on various third-party providers to compose custom workflows, including KYC, AML, and more.

Primus is enabling encrypted data and compute to become verifiable on-chain. We need to provide developers the flexibility to keep their data private while still integrating with blockchain ecosystems.

idOS enables globally scalable KYC/KYB attestation will be crucial to powering regulated transactions on-chain. Gone will be the days where we onboard with the same KYC checks across multiple applications to accomplish the same exact thing. This should all be smart contract based.

We are optimistic that more smart contract-based utilities will emerge to compose applications and flows previously not feasible on-chain. These types of players will serve as critical middleware and infrastructure for the next wave of adoption.

To wrap up, I’ll expand on the broader opportunity to redesign our global financial system.

The Internet Financial System

Historical skepticism about new financial technology follows a familiar pattern:

Credit Cards (1960s): "Only for travel and entertainment"

SWIFT (1970s): "Only for major banks"

PayPal (1990s): "Only for eBay"

M-PESA (2007): "Only for rural remittances"

Stablecoins today: "Only for speculative crypto trading"

The key insight is viewing blockchain metrics (volume, TVL, stablecoin supply, active wallets) as open-source channels for customer acquisition, liquidity, and capital formation. This is what we call tapping into the Internet Financial System (IFS). Applications building natively on the IFS will have the potential to go to market and reach scale faster while leveraging open utilities to share the cost of risk management, compliance, and more.

I have to give credit to Felipe Montealegre from Theia, who is putting out great thinking addressing the implications from first principles (who also perhaps coined the term?)

Taking what this infrastructure can do for payments and capital markets, we envision a few distinct opportunities that could emerge in the not too distant future:

Financial SuperApps. Most superapps are an orchestration of service providers on the backend, abstracted for the end user. Stablecoins make treasury management instant, with funds instantly interoperable between partners. Beyond traditional neobanks, these platforms will connect previously siloed financial services (brokerage, banking, credit, taxes) through stablecoins and tokenized products. The result is seamless value transfer with lower switching costs and a focus on performance over capital hoarding. This opens a massive window for new consumer apps to build on this primitive to compete on an entirely new playing field vs. incumbents.

Stablecoin-Centric Onchain Payment Networks. Unlike Visa's pure take-rate model, these networks will combine stablecoin yields and governance/security tokens to incentivize supply and demand participants who can easily plug in their banking/compliance infrastructure as a ‘node’ powering new stablecoin-based payment networks. The open nature of these networks should lead to open incentive schemes that operate programmatically and trustlessly. No more negotiating bilaterally with stablecoin issuers for a higher share of the underlying yield. This should operate in the open, leading to more efficient schemes such as payment for order flow (PFOF) or Pay-now-settle-later (PNSL) dominating payments and FX transactions.

Internet-Native Capital Markets. As more businesses earn revenues and manage expenses on-chain, we will likely see them raise debt and equity capital on-chain through tokens as a more effective capital formation mechanism. It will take a long time to get there, but it’s clear there is a token liquidity premium vs. traditional equities when looking at token FDVs. Over the next few years, I’d expect this premium to incentivize a major player (crypto native or not) to opt for token issuance as a way to tap into capital markets more efficiently vs. IPO.

Thinking about the future state of IFS enabled applications, one of the most intriguing design spaces will be how we rethink incentive mechanisms. In the age where everything is summoned for us–maybe even by our own personal agents– token-based financial products will have lower switching costs.

Go-to-market and customer acquisition as a function will have to change, introducing new financial platforms not incentivized to increase assets under management, but for delivering on superior performance or providing unique access.

We already live in a world with too many options. Therefore, platforms will likely have to compete for the abstraction layers’ attention (aka our agents’ attention). See Aravind’s comments on advertising in a world of agents.

If we all have an expert financial advisor at our fingertips, asset issuers and payment service providers will have to develop other ways to compete for capital and transaction flow.

The Internet Financial System lets us reimagine how value moves and markets operate. While the immediate opportunities in payments and capital markets are clear, the true potential lies in what we can't yet imagine.

As we've seen with every major platform shift, from the internet to mobile, the most transformative applications often emerge from unexpected places. The opportunity for the next wave of financial applications building on top of blockchains is wide open.

This vision drives our work at VanEck Ventures, and together with Wyatt, we can’t overstate how excited we are to support the visionary teams building today but thinking and living in the future.

If you're a founder working around these ideas, we'd love to hear from you. My DMs (@lagunasounds) are open.

If you read this far, thank you. Please let me know what you think!

I am enormously thankful to Wyatt Lonergan, Joao Reginatto, Nick Van Eck, Nikhil Raghuveera, Peter Schroeder, Farooq Malik, Josh Solesbury, Gabe Rabello, Kurt Larsen, Alex Matthews, and many other awesome builders and investors, many of whose companies I mentioned above, who have helped inform this perspective and provided feedback.

*Disclosures:

*All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met, and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future performance.